(This is an excerpt from an article I originally published on Seeking Alpha on December 3, 2013. Click here to read the entire piece.)

{snip}

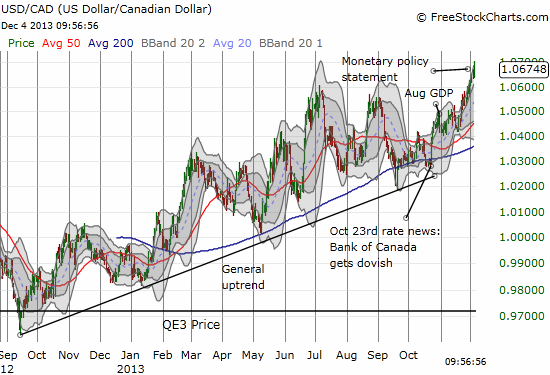

Source: FreeStockCharts.com

The Bank of Canada was consistent with the change of tone from late October’s downgrade of the Canadian economy. In particular, inflation retreated further away from target:

{snip}

This weakened inflation seems odd given the on-going strength in Canada’s housing market, but clearly it is not enough. The Bank of Canada claims that current demand is getting pulled forward from future demand. If so, some kind of softening is around the corner. Indeed, The Bank of Canada expects a “soft landing” ahead for housing. Combine this with “disappointing” non-commodity exports and lower prices for Canadian oil, the recent downgrade of the Canadian economy received extra confirmation. Moreover, the Bank of Canada dismissed the potential positives of stronger than expected GDP growth in the third quarter because “…its composition does not yet indicate a rebalancing towards exports and investment.” In other words, that strength is not sustainable.

Taken together, USD/CAD still seems headed to the 1.08 target I set out back in February, 2013 based on my conclusion that Canada needed a weaker currency to improve its exports and overall economy (see “A Weakening Canadian Economy Needs A Weaker Currency“). {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 3, 2013. Click here to read the entire piece.)

Full disclosure: long USD/CAD