(This is an excerpt from an article I originally published on Seeking Alpha on December 3, 2013. Click here to read the entire piece.)

{snip}

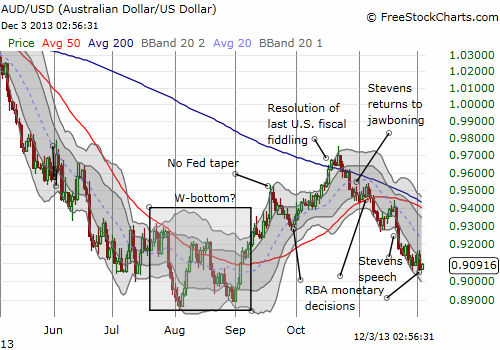

Source: FreeStockCharts.com

After Reserve Bank of Australia (RBA) Governor Glenn Stevens reminded the market that currency intervention remains in the toolkit for currency devaluation, I half-expected some semantic fireworks in the December statement on monetary policy. Instead, the RBA said nothing new and left the Australian dollar hanging for the year with a very familiar, almost wistful observation: “The Australian dollar, while below its level earlier in the year, is still uncomfortably high. A lower level of the exchange rate is likely to be needed to achieve balanced growth in the economy.” The Australian dollar barely budged in response.

Traders are now left looking for new catalysts to grease the skids for the Australian dollar. Stephen Koukoulas, Managing Director of Market Economics and former Senior Economic Advisor to former Australian Prime Minister, Julia Gillard MP, made an interesting proposition in pointing to bulging levels of foreign debt. In “Foreign debt surges but does anyone care?“… {snip}

{snip}

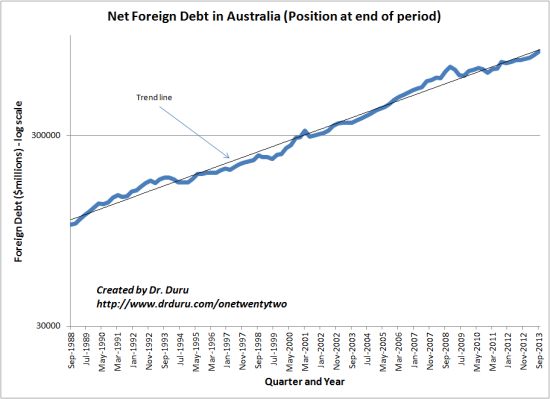

Source: Australia Bureau of Statistics

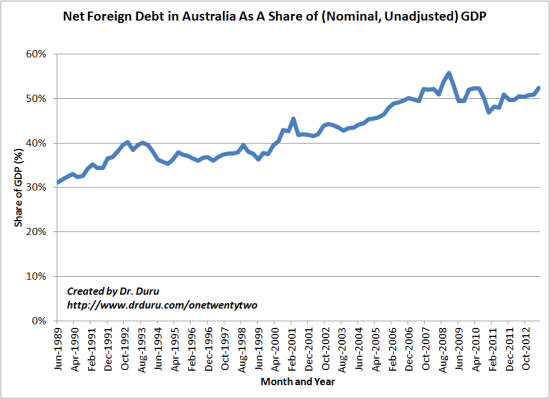

Source for GDP: Australia Bureau of Statistics

The foreign debt is plotted using a log scale to show clearly the linear trend in growth. {snip}

To calculate the percent of GDP, I took the value of foreign debt for a given quarter and divided it by total GDP over a rolling four quarters. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 3, 2013. Click here to read the entire piece.)

Full disclosure: no positions