(This is an excerpt from an article I originally published on Seeking Alpha on November 21, 2013. Click here to read the entire piece.)

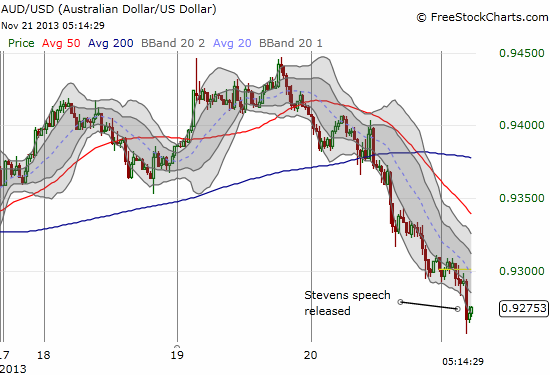

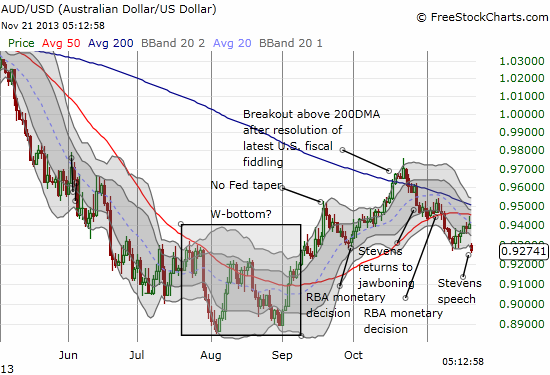

As I noted earlier this week, I was eagerly anticipating the release of the minutes from the last policy meeting of the Reserve Bank of Australia (RBA) and a speech by Governor Glenn Stevens at the Australian Business Economists’ Annual Dinner. I have not fully processed the minutes, but they had little impact on the Australian dollar (FXA) anyway as they contained no new headline information. I did process Governor Stevens’ speech as his words once again greased the skids for the Australian dollar.

The speech was aptly titled “The Australian Dollar: Thirty Years of Floating.” Stevens had five main topics: the historical reason for floating the currency in 1983, a description of how the market has evolved since then, a related discussion on how the exchange rate has behaved since then and the impact of the float, a review of whether the exchange rate has been mispriced, and, finally, a discussion of intervention. I think the musings about intervention caught the greatest interest of traders.

{snip}

In other words, the RBA thinks it knows how and when to intervene in the currency markets and expects to be very successful with any intervention strategy over the course of time. {snip}

While the Australian dollar slipped a bit on the heels of the release of the speech, the overall slide in the Australian dollar versus the U.S. dollar has come on the heels of a renewal expectations for an imminent tapering of the U.S. Federal Reserve’s bond purchases. {snip}

{snip}

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on November 21, 2013. Click here to read the entire piece.)

Full disclosure: net long AUD/USD