(This is an excerpt from an article I originally published on Seeking Alpha on November 11, 2013. Click here to read the entire piece.)

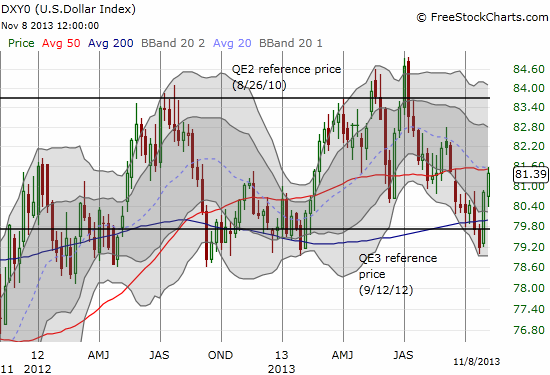

The next statement on monetary policy from the U.S. Federal Reserve comes on December 18th. With taper expectations on the rise again thanks to the 204,000 jobs added in October, it appears that the U.S. dollar (UUP) has at least five weeks of upward bias as it turns the corner from the recent sell-off. I have argued recently that the U.S. dollar is essentially stuck in an approximate trading range that has tightened in the last two years. I concluded then that the U.S. dollar index would eventually trade back up to the top of that range in due time. The “sloppy” bounce from the lower part of that range looks underway and perhaps within the next five weeks, the dollar index will tag the upper part of the range.

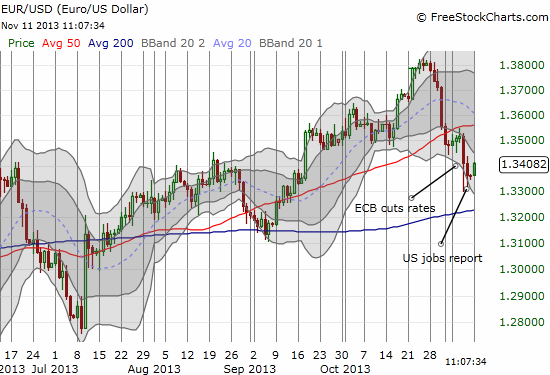

The prospect of a stronger dollar has some important ripple effects – first and foremost is on the euro (FXE). {snip}

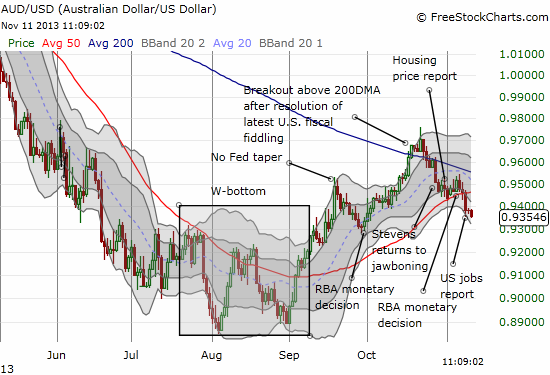

The stronger U.S. dollar is so far pressuring the Australian dollar (FXA) as well. I earlier suggested that the Reserve Bank of Australia (RBA) is pinning hopes on Fed tapering as part of its desire for a weaker currency. {snip}

{snip}

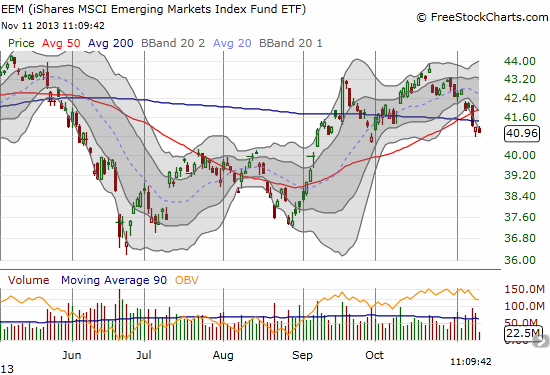

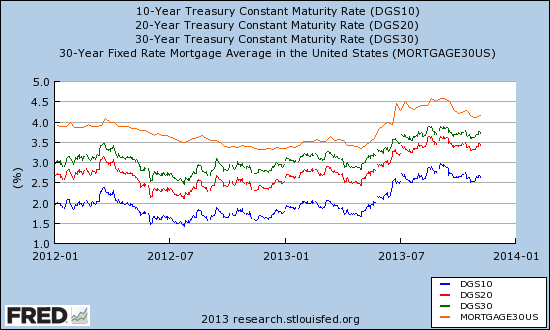

Finally, outside of foreign exchange, the higher rates that come with tapering fears are pressuring emerging markets all over again. For example, the iShares MSCI Emerging Markets (EEM) continued a sell-off that has been in place for over two weeks. {snip}

Source for stock and currency charts: FreeStockCharts.com (captured intraday 11/11/13)

Source: St. Louis Federal Reserve

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on November 11, 2013. Click here to read the entire piece.)

Full disclosure: long U.S. dollar, short euro, neutral on the Australian dollar, long EEM calls, long SSO puts, long SDS shares