(This is an excerpt from an article I originally published on Seeking Alpha on November 21, 2013. Click here to read the entire piece.)

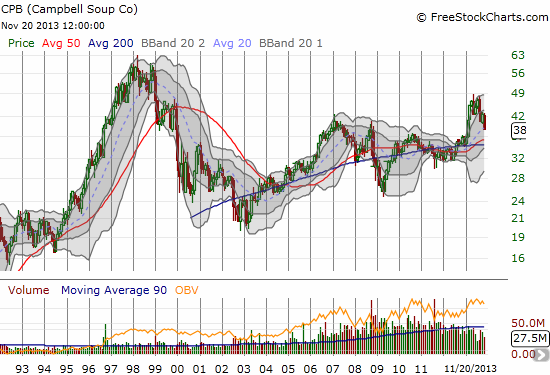

You know it must be a good year in the stock market when a soup and food products company can deliver 11% gains year-to-date. Unfortunately for Campbell Soup (CPB), its 11% year-to-date gain is significantly DOWN from its closing high for the year on May 15th when the stock was up an incredible 38%.

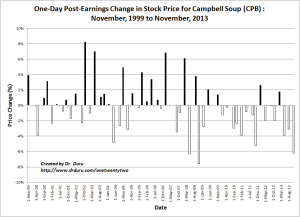

This 6-month tumble caught my eye and my interest after seeing the stock fall 6.2% in reaction to its latest earnings report. The one-day post-earnings reaction was CPB’s second worst since 1999. The stock fell 6.3% in response to earnings on May 19, 2008. Interestingly, CPB tends to trade down following earnings as shown in the chart below. This means that these dips also tend to be buying opportunities given CPB’s overall upward trajectory. However, with three straight sizeable post-earnings drops and losses 14 out of the last 16 earnings, I cannot help but wonder whether 2013’s early run-up was an aberration of historical proportions for CPB.

Click image for larger view…

Source: Briefing.com for earnings dates, Yahoo Finance for stock price data

{snip}

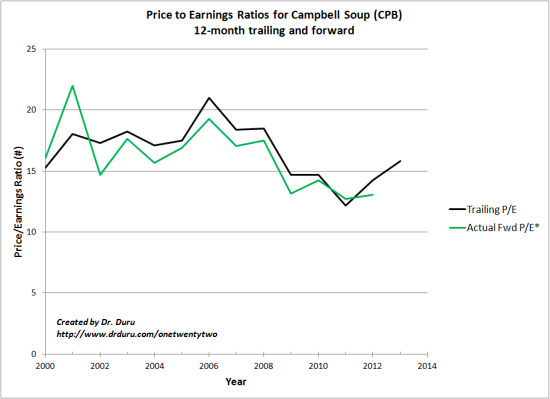

Click image for larger view…

CPB has experienced years of meager revenue growth but has managed to squeeze out several years of decent earnings growth although almost never in the double digits. Yet, investors tend to pay up for CPB. {snip}

*See above for explanation of 12-month forward P/E ratio

{snip} CPB noted a host of headwinds including “weakness in core business trends.”

During the earnings call (Seeking Alpha transcript), CPB Chief Financial Officer tried to reassure analysts that the company has “…some offsets and some benefits to the balance of the year.” {snip}

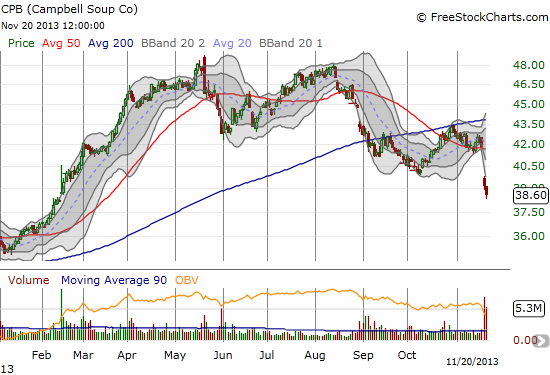

I was hoping in CPB’s post-earnings shellacking to find a cheap rebound play. Now, I am not so sure. The valuation seems far too high to make the risk worth taking. The stock has been breaking down since the May peak. The steady decline may not end until at least all of 2013’s (aberrant?) gains get reversed…

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on November 21, 2013. Click here to read the entire piece.)

Full disclosure: no position