(This is an excerpt from an article I originally published on Seeking Alpha on November 1, 2013. Click here to read the entire piece.)

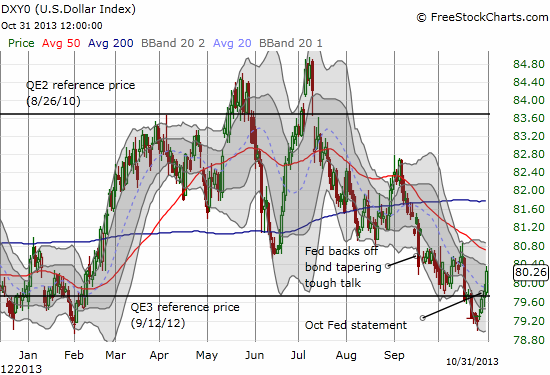

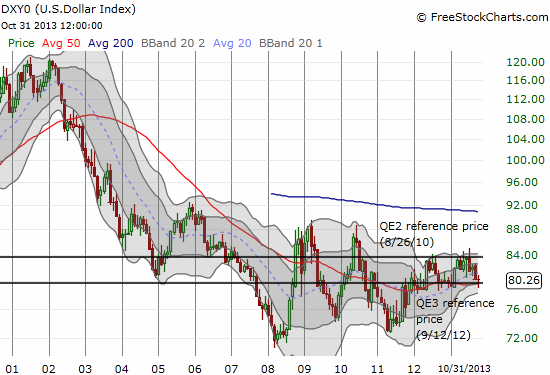

The U.S. dollar (UUP) sold off steadily going into Wednesday’s (October 30, 2013) statement from the Federal Reserve on monetary policy. It has been a slow yet relatively steady grind lower until the index finally cracked levels last seen in early February which also happen to coincide with the dollar’s level at the time QE3 was announced a little over a year ago. So, at first blush, it seems strange that the dollar is rallying in the wake of a Fed statement that contained no tapering and no specific tapering timetable. In fact, a broad examination of the statement remains consistent with a high likelihood that tapering is off the table until 2014.

The Fed statement directly blamed the fiscal mess in Washington for its decision to back off from tapering (emphasis mine):

{snip}

Despite the acknowledged slowing in the housing recovery, the Fed stuck to a story of “underlying strength.”

{snip}

These broad swings in the U.S. dollar almost make the market look overall indecisive, if not confused: there is still no strong catalyst for taking the dollar outside of its current comfort zone. As such, I am sticking with my expectation that in due time, the dollar will trade back up to the top of its trading range at least to its QE2 price.

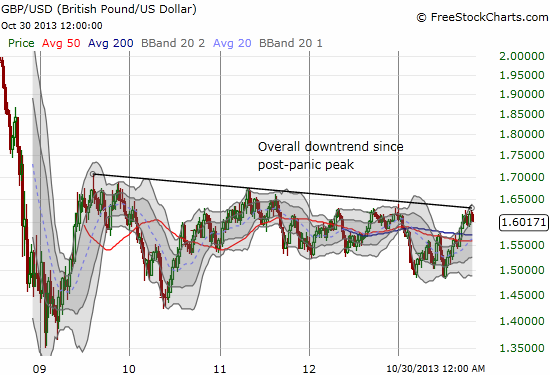

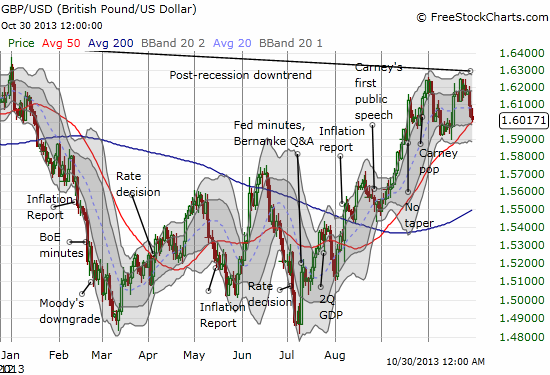

My one caveat is the British pound (FXB). {snip}

Source for charts: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on November 1, 2013. Click here to read the entire piece.)

Full disclosure: net long U.S. dollar, long GBP/USD