(This is an excerpt from an article I originally published on Seeking Alpha on May 19, 2013. Click here to read the entire piece.)

Time to swivel heads around on the Australian dollar (FXA) yet again.

In “Australian Dollar’s Relief Rally Ends With The Latest RBA Meeting Minutes,” I concluded that the Reserve Bank of Australian (RBA) signaled it is willing to continue cutting rates until the Australian dollar drops to more acceptable levels. Now, I am not so sure as this week’s statement on monetary policy excluded the critical cover that the RBA has used to signal the potential for lower rates.

{snip}

September’s statement said absolutely nothing about scope and did not reference the outlook for inflation. The RBA only stated that inflation “has been consistent with the medium-term target.” Implicitly, the RBA seems to be suggesting that the cash rate target has gone as low as it can given current inflation (and the outlook). I almost missed these subtle changes. {snip}

{snip}

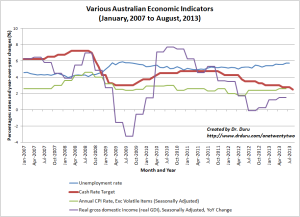

(January, 2007 to August, 2013)

Source: Reserve Bank of Australia Statistical Tables

So, the cash rate target (thick red line) is now roughly equivalent to the inflation rate (green line). There appears to be no further “scope” for lower inflation. {snip}

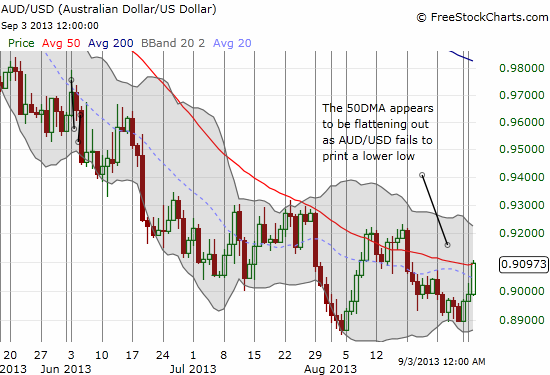

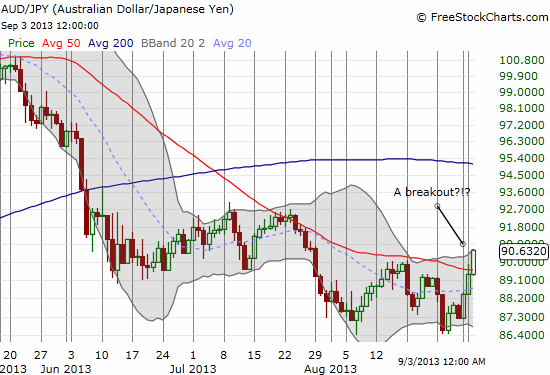

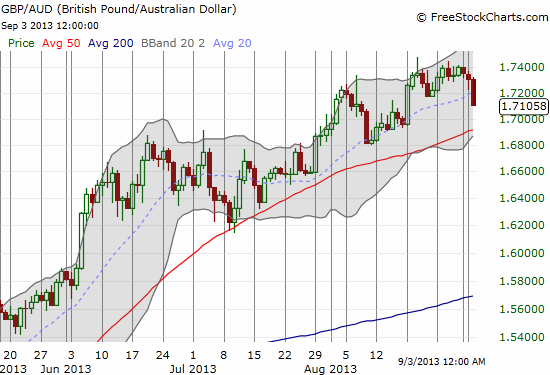

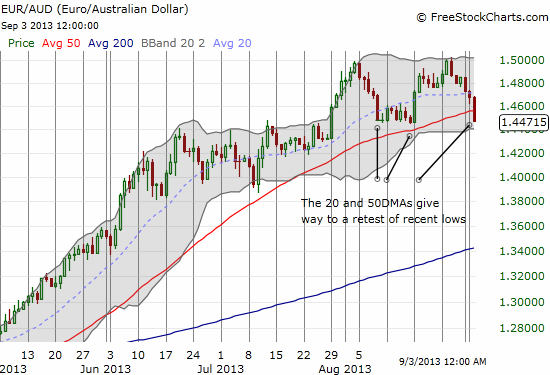

Source for charts: FreeStockCharts.com

Trading the Australian dollar now gets very tricky. {snip}

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 19, 2013. Click here to read the entire piece.)

Full disclosure: net short the Australian dollar