(This is an excerpt from an article I originally published on Seeking Alpha on August 15, 2013. Click here to read the entire piece.)

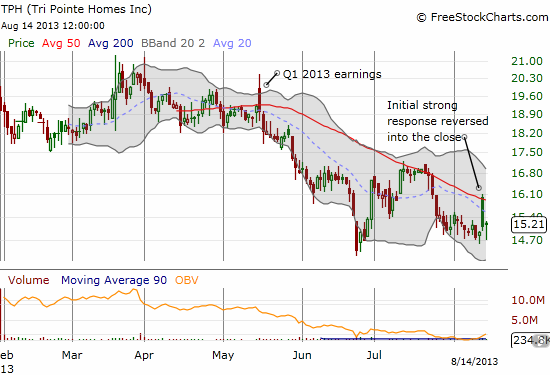

TRI Pointe Homes (TPH) reported very strong earnings for the second quarter of 2013. {snip}

Year-over-year results were strong, and TPH raised guidance for the year. {snip}

Based on strong demand, growth in the backlog, and high absorption rates, TPH upped its revenue and margin guidance and provided EPS guidance for the first time. {snip}

{snip}

The company insisted that interest rates are not the most important drivers of housing demand. TPH pointed to consumer confidence, household formation, and employment as the key ingredients. Consumer confidence is relatively high nationwide, but employment and household formation remain lackluster. TPH has of course strategically built its communities where job growth is strong (and presumably household formation relative to available inventory is above the national average).

TPH says it has not seen a slowing in demand in any of its communities across Northern and Southern California or Colorado. {snip}

So with these bullish results, why the sour response? Clearly, the market refuses to believe these results are sustainable – even increased guidance is getting ignored. This is both an opportunity and a warning. {snip}

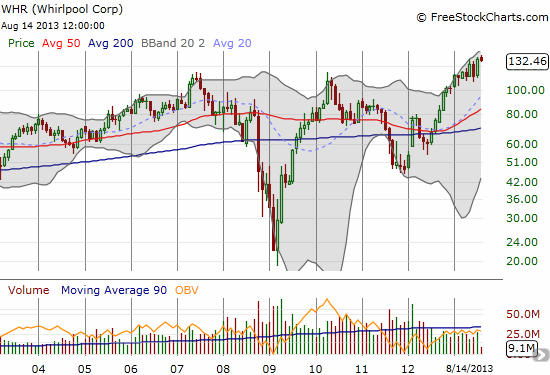

I find it interesting to contrast the poor response to homebuilders with the generally positive response that Whirlpool (WHR) received for its very bullish guidance on July 19th in hiking expectations for demand in North America.

{snip}

Continuing with the bullish assessment of North American demand, particularly in the U.S.:

{snip}

So, even with continued weakness in demand in Europe, a hiccup in Brazil due to social and political unrest, and a flat year-over-year forecast in revenues for Asia, WHR’s stock jumped 8.0% after earnings. {snip}

Source: FreeStockCharts.com

I think a major disconnect exists in the way homebuilder companies are being treated versus other companies highly dependent on a strong housing market. Most are declaring messages from the same themes. Whirlpool is still able to ride a story of improved margins and strong leverage. The margin story is no longer working for homebuilders (and granted a few homebuilders threw up stinkers this past earnings season: DHI and PHM). This disconnect should get resolved in due time. In the meantime, I am still getting ready to accumulate more homebuilders on lower prices.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 15, 2013. Click here to read the entire piece.)

Full disclosure: long TPH