(This is an excerpt from an article I originally published on Seeking Alpha on May 7, 2013. Click here to read the entire piece.)

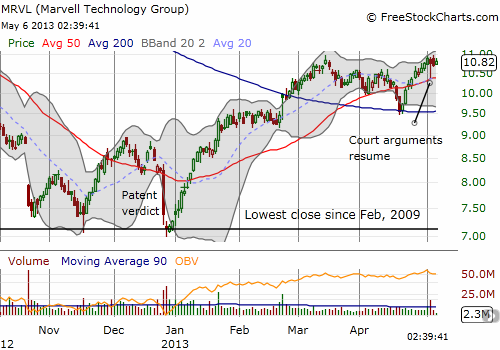

Marvell Technology (MRVL) has enjoyed a tremendous run since hurtling downward after a legal setback in its patent dispute with Carnegie Mellon back in December. At the time, I thought it would consign MRVL to dead-money status until legal arguments resumed in May of this year (see “Loss in Patent Case Turns Marvell Technology Into Dead Money“). Just one week later, I realized that the stock was exhibiting classic signs of printing a sustained bottom (see “Chart Review: Stronger Signs Of A Bottom for Marvell Technology“). A quick plunge and recovery in the stock on May 2nd as legal arguments resumed was a great reminder of how the patent infringement case may yet impact the stock.

Source: FreeStockCharts.com

{snip}

Regardless, I had May painted red in my calendar for MRVL, and on May 1st I decided it was time for some share replacement therapy to help me sleep at night through the final settlement of this case. On May 1st, I tweeted that call options looked exceptionally cheap.{snip}

{snip}

Even with these promising signs as backdrop, I executed the share replacement therapy. I promptly replaced my shares with January, 2014 call options. {snip}

From the press reporting of the case, it seems that MRVL is planting its hopes on getting the judgment significantly reduced, if not eliminated.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 7, 2013. Click here to read the entire piece.)

Full disclosure: long MRVL call options.