(This is an excerpt from an article I originally published on Seeking Alpha on August 8, 2013. Click here to read the entire piece.)

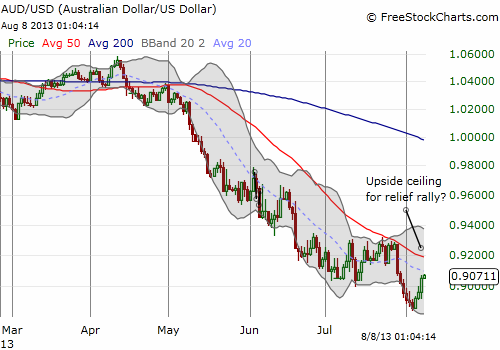

The move has occurred in fits and starts, but the relief rally I anticipated for the Australian dollar (FXA) appears to be underway.

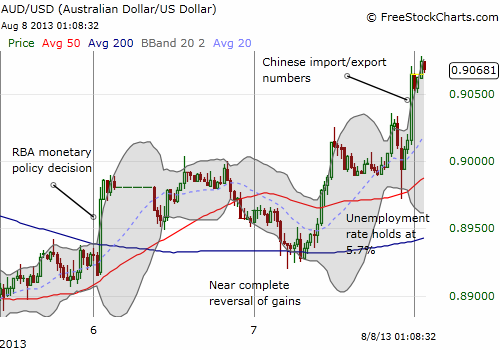

The latest decision on monetary policy from the Reserve Bank of Australia (RBA) contained no surprises. {snip}

The RBA did not deliver any fresh catalyst for expecting even lower rates. So it made sense that after this announcement, the currency essentially had nowhere to go but up in a contrarian, counter-trend move. {snip}

{snip} While the Australian dollar is not a member of the U.S. dollar index (UUP), AUD/USD will likely fall again if/once the dollar index bounces off the bottom of its presumed trading range (as I expect it to do).

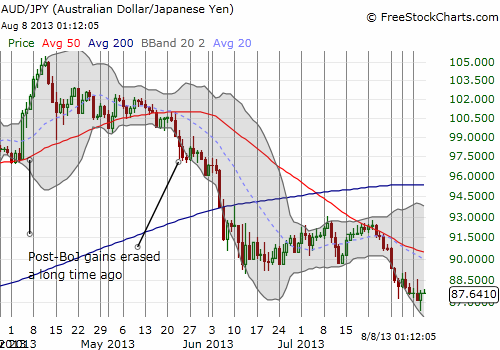

{snip}

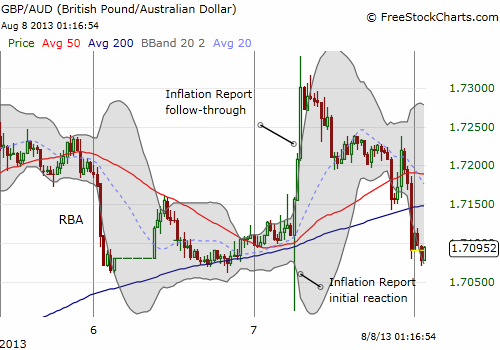

{snip}

{snip}

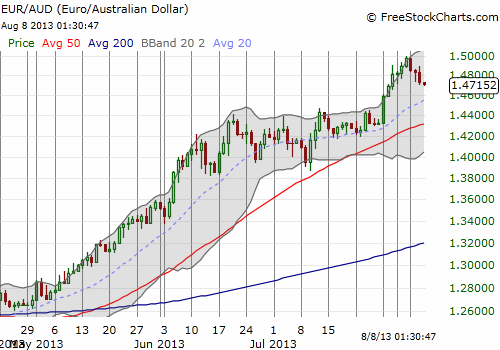

Source for charts: FreeStocCharts.com

It is of course hard to tell how long the relief rally will last for the Australian dollar – a halt at the 50-day moving average shown in the second chart above seems just as good as a stopping point as any. RBA Governor Glenn Stevens finally has the market’s full attention, so we should expect significant downside risk to the currency whenever he gets up to speak…{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 8, 2013. Click here to read the entire piece.)

Full disclosure: net long Australian dollar, net long U.S. dollar (mainly against the euro and yen)