(This is an excerpt from an article I originally published on Seeking Alpha on August 12, 2013. Click here to read the entire piece.)

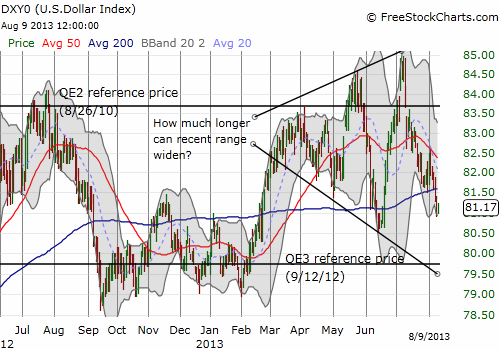

As the clock ticks down to a double whammy of a possible pullback in the Federal Reserve’s bond purchases and/or another drama-filled countdown to a U.S. government shutdown, the U.S. dollar (UUP) has weakened from three-year highs to recent lows. If what has been happening since April is a steady widening of the most recent trading range, then the U.S. dollar will soon retest its “QE3 reference price” before bouncing. If all that is happening is directionless wandering while the market waits for a definitive catalyst, then a bounce could just as well happen in the next week or so as the low from June gets tested. Either way, I think it makes sense to prepare for a bounce.

Source: FreeStockCharts.com

I tried to come up with a core, fundamental rationale for the dollar’s movements or for why it should soon bounce. Such justifications eluded me. {snip}

I prefer to think of today’s foreign exchange market in general as being dominated by a lot of trendless forces. {snip}

The most intriguing aspect of the U.S. dollar’s behavior is its relationship, or lack thereof, to the stock market and interest rates.

{snip}

Source: St. Louis Federal Reserve

The stabilization in rates post-QE3 coincided with the end of the dollar’s sharp decline going into the QE3 announcement. {snip}

…If despite all these possibilities the U.S. dollar index manages to break below the lows of its range, it will then be time to go back to the storyboard…

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 12, 2013. Click here to read the entire piece.)

Full disclosure: long U.S. dollar, net long Australian dollar, long British pound