(This is an excerpt from an article I originally published on Seeking Alpha on July 10, 2013. Click here to read the entire piece.)

{snip}

…a fascinating story about a 2-man team, a real estate agent and a contractor, who have gone from boom to bust and hopeful boom. They went from a whiteboard full of developments to one lonely desert plot in Lancaster, CA (abut 70 miles north of Los Angeles). After seven years, this vacant lot is finally getting developed with funding from private investors. The real estate agent believes that they will sell out of the 44 homes beginning construction in about three months based on current sales trends.

Weinberg did not ask whether interest rates would impact this bullish forecast. {snip}

Source: St. Louis Federal Reserve

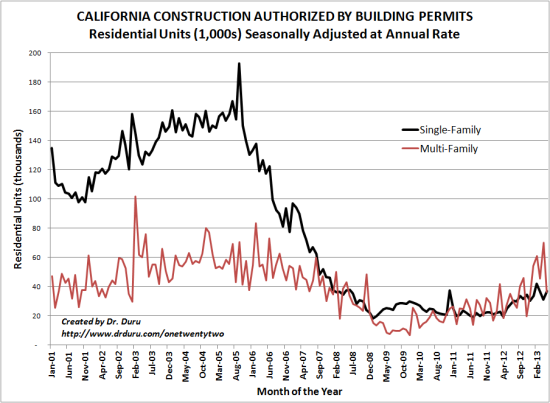

However, if the economy is truly improving and higher rates reflect the long overdue decrease in deflationary fears, then the more important data will be like the ones below. {snip}

Source: California Department of Finance

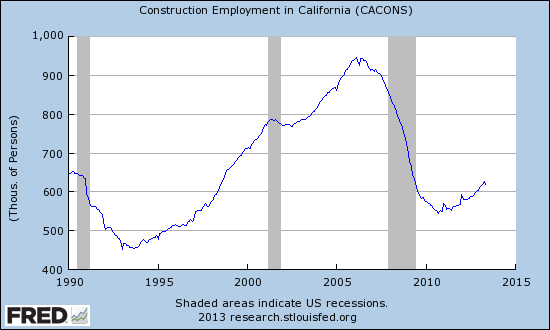

A pickup in construction, even something less than a new boom, should also have a dramatic spill-over effect into jobs. Overall construction employment in California remains at depressed levels.

Source: St. Louis Federal Reserve

And more jobs should eventually add more housing demand…

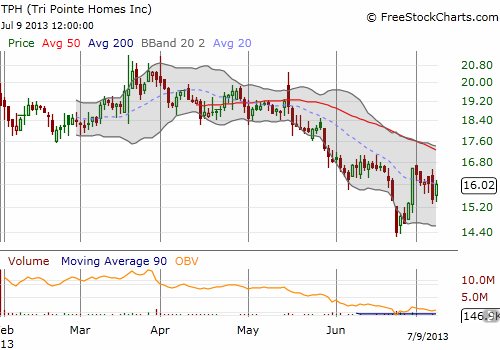

{snip} In particular, I have been targeting Tri Point Homes Inc. (TPH) given its high concentration of business in California. {snip}

Source: FreeStockCharts.com

Given the uncertainty of the immediate or near-term impact of higher rates, I have not yet started a new buying cycle of shares of other homebuilders, but my top picks remain the same (see for example, “Homebuilder Price Performance Diverges In 2013 As Shorts Continue An Uneven Retreat“).

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 10, 2013. Click here to read the entire piece.)

Full disclosure: long TPH