(This is an excerpt from an article I originally published on Seeking Alpha on April 21, 2013. Click here to read the entire piece.)

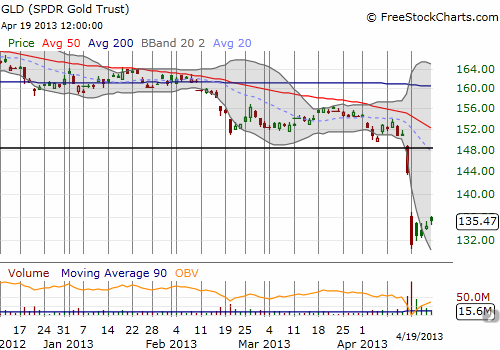

On April 14th, I wrote my reasons for believing that a bottom for gold would prove elusive. At the time, I was thinking gold (GLD) could experience a new extended phase of weakness. I definitely did not anticipate a collapse in prices on the very next trading day (April 15th).

Source: FreeStockCharts.com

{snip}

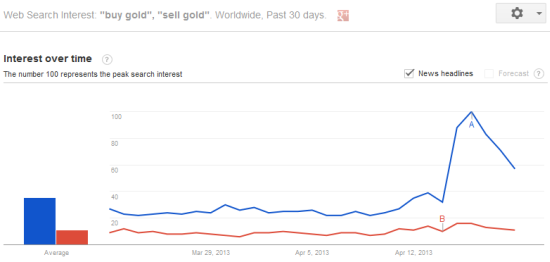

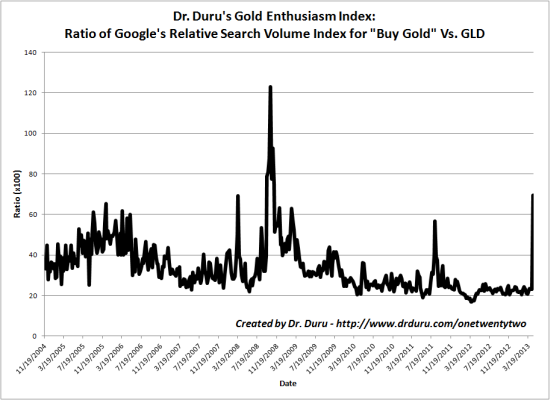

Adding to the case for a bottom (or “close enough” to one) is the surge in my stylized “Gold Enthusiasm Index.” {snip}

Source: Google Trends

{snip}

{snip}

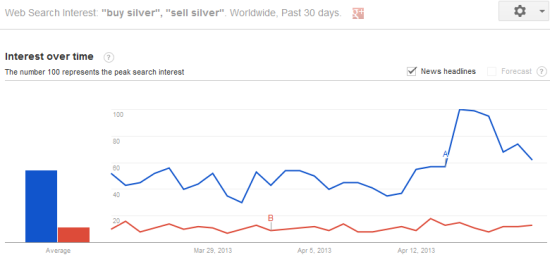

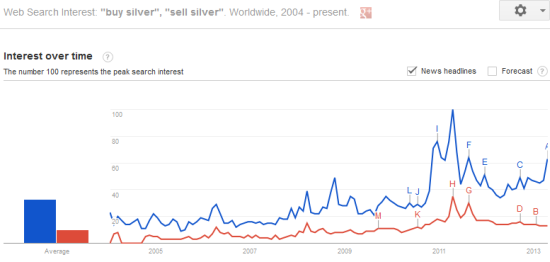

Perhaps one interesting and confirming twist is the Google Trend view on silver (SLV) search terms. It turns out that “buy silver” and “sell silver” follow similar patterns to gold. {snip}

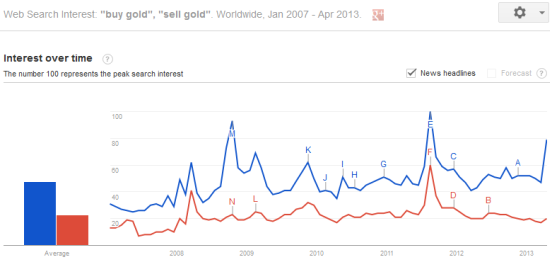

Source: Google Trends

{snip}

Source: Google Trends

{snip}

Source: FreeStockCharts.com

{snip}

In the meantime, I will continue to be amazed by the amount of chatter suggesting that gold’s collapse is a harbinger of deflation. {snip} Perhaps inflation will become a palpable threat once after enough people finally conclude the global economy will never see real inflation again…

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 21, 2013. Click here to read the entire piece.)

Full disclosure: long GLD, GG, SLV, PAAS