(This is an excerpt from an article I originally published on Seeking Alpha on February 25, 2013. Click here to read the entire piece.)

On February 22nd, Reserve Bank of Australia (RBA) Governor Glenn Stevens spoke with the Australian House of Representatives Standing Committee on Economics. {snip}

In his opening statement, Stevens delivered a nice twist by claiming that interest rate policy is not targeting a lower Australian dollar; instead, the RBA has lowered rates to provide a buffer for the potential economic harm from a stubbornly high exchange rate (emphasis mine):

{snip}

Next, a committee member noted that he could not remember an opening statement in which Stevens stated a direct reference to the impact of the Australian dollar. {snip}

In other words, the high exchange rate has motivated the RBA to push rates lower than it otherwise would have done. Some (much?) of the blame for this high exchange rate goes to external capital flowing into the country and/or speculating on the currency…and of course, lower rates dampen those flows to some extent.

Another member (Dr. Lowe) of the RBA went much further to paint the specifics on the linkage between interest rates and the exchange rate:

{snip}

So by default, the Australian dollar must be high because it is not creating money and economic conditions are much stronger than North Atlantic countries. Yet, low rates beget low rates: lower rates in an economically weak zone force rates lower in a relatively stronger zone (which in turn likely slows the recovery of the weaker zone). {snip}

Stevens confirms that while the RBA believes the Australian dollar is higher than it should be, it is not so high to compel an intervention. In fact, Stevens claimed that sooner or later, the market tends to correct episodes of extreme over-valuation:

{snip}

Stevens prefers to rely on the markets to set the rate even if they are “irrational much of the time”:

{snip}

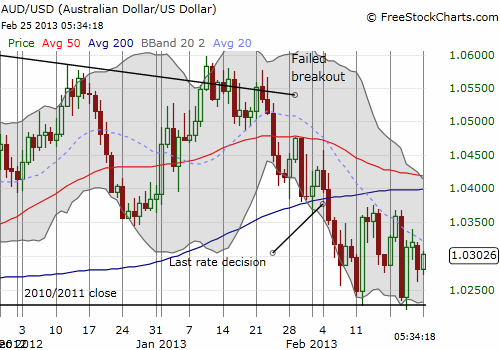

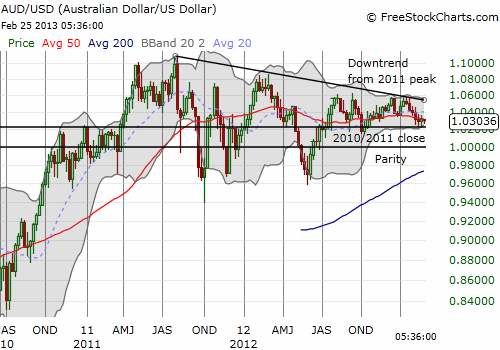

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 25, 2013. Click here to read the entire piece.)

Full disclosure: short AUD/USD