(This is an excerpt from an article I originally published on Seeking Alpha on February 25, 2013. Click here to read the entire piece.)

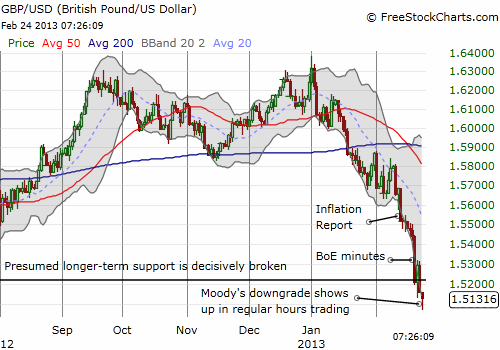

Shortly after U.S. trading closed on Friday, February 22nd, Moody’s downgraded UK debt one notch from Aaa to Aa1 with a stable outlook. This downgrade is a natural extension of the “negative outlook” rating Moody’s slapped on the UK a year ago. Moody’s is projecting economic weakness into the second half of this decade; no surprise to anyone following the last Bank of England Inflation Report. Moody’s is concerned that the UK’s slower than expected growth will allow increasing debt burdens, peaking at 96% of GDP in 2016. This pattern presents “…a risk that the UK government may not be able to reverse the debt trajectory before the next economic shock or cyclical downturn in the economy.” Thus, the UK does not possess the kind of policy flexibility that other Aaa-rated sovereigns have.

However, on balance, the news is not too bad. Moody’s granted the UK a stable outlook…{snip}

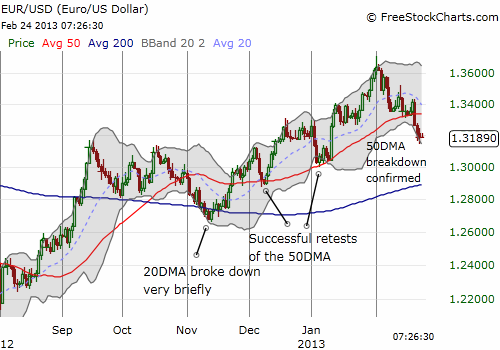

This advantage the UK has over the eurozone is one reason that I continue to think that playing a fade of the euro versus the pound (EUR/GBP) makes sense. {snip}

…Typically, these trigger-happy reactions to debt downgrades are almost as swiftly reversed. As I type, the reversal is finally starting (and this is the way to play such news in the short-term).

{snip}

Source of charts: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 25, 2013. Click here to read the entire piece.)

Full disclosure: long GBP/USD, short EUR/GBP, short EUR/USD