(This is an excerpt from an article I originally published on Seeking Alpha on March 17, 2013. Click here to read the entire piece.)

{snip}

While it is still far from clear that the risky bailout plan for Cyprus will pass the country’s legislative body – a vote that was scheduled for Sunday has been postponed to Monday at the time of writing – it does seem clear that the unprecedented plan to seize money from even insured savings accounts is causing worries about financial contagion. {snip}

{snip}

While many factors played into the construction of the current plan, I am assuming that important enablers are the low level of volatility in global financial markets and the related notion that the eurozone has finally conquered tail risks for its currency. These presumptions of reduced risk give rulemakers a (false?) sense of security and a larger platform for taking risks. On the surface at least, it seems the financial system has plenty of buffer to contain and absorb any fallout.

Cyprus’s small size probably contributes to the notion that whatever happens in the country can be well-contained. {snip}

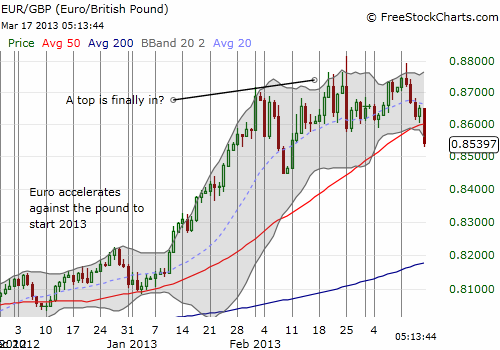

So, contagion does not respect size and what seems small now could certainly loom very large in the future. In the currency markets, this means opportunity. {snip}

{snip}

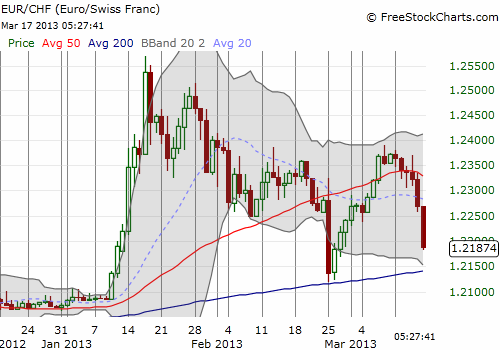

Of all the euro-impacted currencies to watch during whatever unfolds, I will focus again on the Swiss franc (FXF). {snip}

Above all, I think gold (GLD) should shine here. {snip}

Source of charts: FreeStockCarts.com

Through it all, traders must keep in mind BOTH the bearish and bullish opportunities that renewed volatility present. {snip}

Finally, here is a cartoon I found from twitter that surely expresses the feelings of those in Cyprus:

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on March 17, 2013. Click here to read the entire piece.)

Full disclosure: long GLD