(This is an excerpt from an article I originally published on Seeking Alpha on February 18, 2013. Click here to read the entire piece.)

Traders sometimes copy the trading in options showing unusual trading activity under the assumption that someone (or some people) have privileged insight into an imminent big event or the short-term price trend for the underlying stock. {snip} So I took special interest in reading about the SEC’s recent action to move against traders who allegedly used a Goldman Sachs (GS) account in Switzerland to load up on call options one day ahead of the buyout of H.J. Heinz (HNZ) by Berkshire Hathaway and 3G Capital.

The SEC summarizes its rationale in the complaint:

{snip}

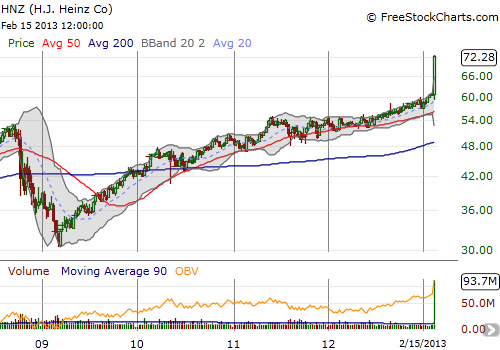

The traders specifically purchased 2,533 out-of-the money June $65 calls. The trading clearly shows up in the chart below:

After reading the press release and the SEC complaint, here is my interpretation of what constitutes a warning sign of likely insider trading in options:

{snip}

The overall open interest in the Heinz June $65 call is actually not the largest of the strikes. In particular, there is currently open interest of 4,578 contracts in the June $60 call. {snip}

Source for options trading info: Etrade.com

The trading in the June $60 call fails to meet many of the SEC’s implicit and explicit criteria for generating warning flags. {snip}

The implication in all this action is that insider trading is hard to prove given a confluence of factors. This also reminds options traders that options trading can send signals opposite to what seems apparent on the surface. {snip}

So, without the insider information of the SEC, interpreting options action will always be part art, part science. Ultimately, perhaps an even bigger lesson in the trading on HNZ is that stocks which make fresh all-time highs do so for good reasons!

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 18, 2013. Click here to read the entire piece.)

Full disclosure: long HLF