(This is an excerpt from an article I originally published on Seeking Alpha on March 6, 2013. Click here to read the entire piece.)

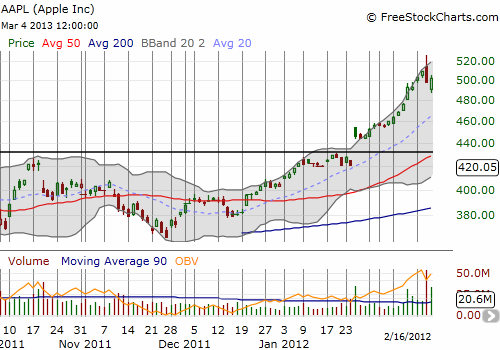

In late December, I wrote about negative sentiment growing in Apple (AAPL). Apple has fallen another 100 points since then for a 19% loss, yet, negative sentiment has not grown. In fact, if anything, sentiment overall has gotten more bullish. This setup renders bottom-calling in AAPL near useless. After the stock broke through my presumed support at $432 and now even hit my rock bottom target of $420, I am indeed more wary than ever of even more downside. In December, I projected this downside target because it would fill January, 2012’s big gap up that marked a major breakout at the time:

{snip}

The bullish sentiment is currently reflected in analyst ratings and the open interest put/call ratio. Negative sentiment has failed to grow through shares short.

{snip}

…it is hard to fault analysts for getting more bullish after a 10% drop in AAPL. After all, AAPL is in a long-term secular bullish uptrend. Previous drops of such a magnitude were golden buying opportunities. In particular, AAPL reached an all-time closing high on April 9, 2012 at $636.23. In just two weeks, AAPL fell by 12% before soaring the day after earnings (see “The Odds Favor Big Upside from Apple’s Fiscal 2012 Second Quarter Earnings“). {snip}

{snip}

So, with the stock this cheap, no surprise then that the high price target sits at a now seemingly lofty $888 and a median $610. Even the low target of $465 is now too high.

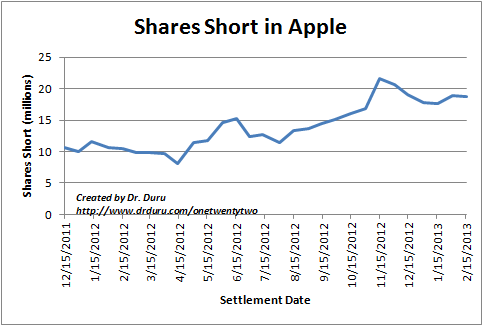

When I wrote last December, short interest on AAPL was on the rise, doubling from the end of July and increasing 33% from September. Since then, short interest has actually tapered off. (Note that shorts are still only 2% of AAPL’s float).

Source: NASDAQ short interest

{snip}

Along with the relative disinterest from bears to add to positions is the continued strong bias toward call options over put options on AAPL. {snip}

So, overall, the “only” thing bearish about Apple now is its stock price. And it is not pretty.

{snip}

Source: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on March 6, 2013. Click here to read the entire piece.)

Full disclosure: long AAPL