(This is an excerpt from an article I originally published on Seeking Alpha on March 13, 2013. Click here to read the entire piece.)

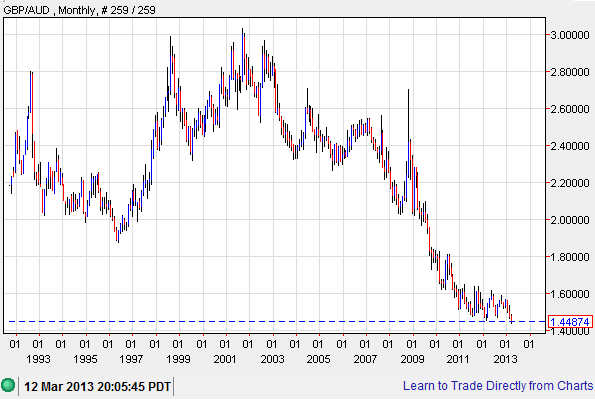

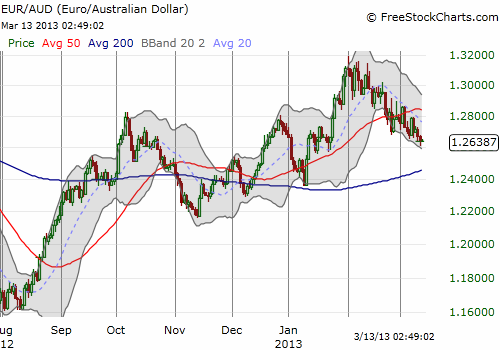

It took a record low on the GBP/USD currency pair [British pound (FXB) versus the Australian dollar (FXA)] for me to realize that the Australian dollar has been in “stealth rally” mode this year. Depending on how one measures it, the Australian dollar has been quietly rallying since October of last year when iron ore prices lifted off a deep trough. Only the stubborn strength of the U.S. dollar has masked the underlying strength in the Australian dollar.

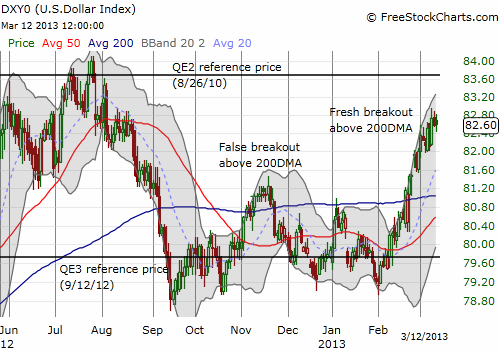

First, a chart of the U.S. dollar index shows that the dollar never suffered much from QE3. {snip}

Next, a chart of the the British pound versus the Australian dollar (GBP/AUD) clearly demonstrates that the Australian dollar is still on a historic run. {snip}

Source: Dailyfx.com charts

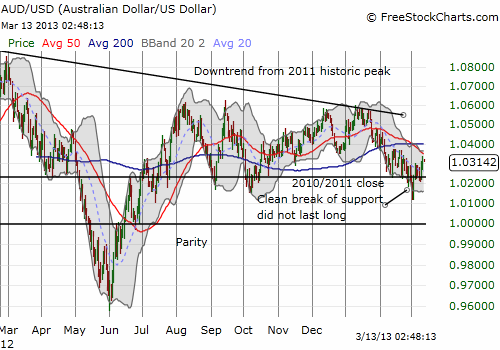

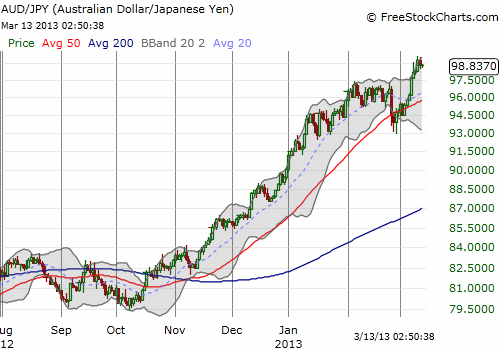

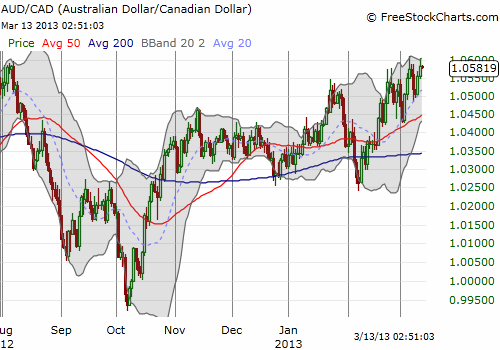

For a while now, I have mainly fixated on AUD/USD, the Australian dollar versus the U.S. dollar, and how it correlates with the S&P 500 (SPY). It turns out that the U.S. dollar is the main currency that has consistently out-performed the Australian dollar over the past few months. {snip}

{snip}

Source for charts except where otherwise noted: FreeStockCharts.com

For some context on this stealth rally, it helped me to review the last statement on monetary policy from last month, an extensive report that the Reserve Bank of Australia (RBA) produces on Australian and global macro-economic conditions.

The overall message again is that, all things considered, the Australian economy is OK and remains one of the strongest amongst the world’s major economies:

{snip}

The persistent strength in the Australian dollar that is part of this stealth rally is indicative of a market that is waiting to see real evidence that the Australian economy is starting to suffer from the strong currency. In other words, it is very likely that the currency will not weaken notably until economic data forces the issue. Until then, the Australian dollar seems likely to continue exhibiting strength against most of the major economies where interest rates are near or at zero.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on March 13, 2013. Click here to read the entire piece.)

Full disclosure: short AUD/USD, long AUD/JPY