(This is an excerpt from an article I originally published on Seeking Alpha on February 3, 2013. Click here to read the entire piece.)

{snip}

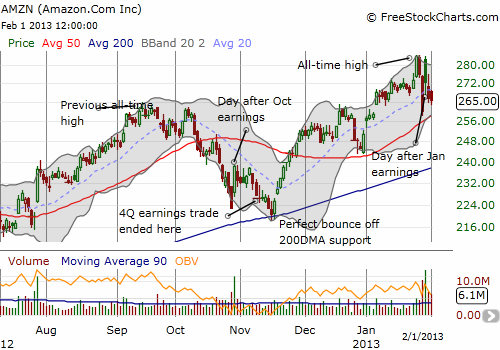

Another Amazon.com (AMZN) earnings call, more unimpressive guidance (this time, Q1 guidance for $15.0 to 16.6B revenue below expectations and for operating income -$285 to 65M around expectations), an immediate plunge in after-hours trading (this time, to $250), a rapid recovery, and a strong open the next day. However, THIS time, the stock could not maintain a bullish feeling. {snip}

As a reminder, the rule for trading AMZN post-earnings is to buy the open and sell within two weeks. {snip}

{snip}

Source: FreeStockCharts.com

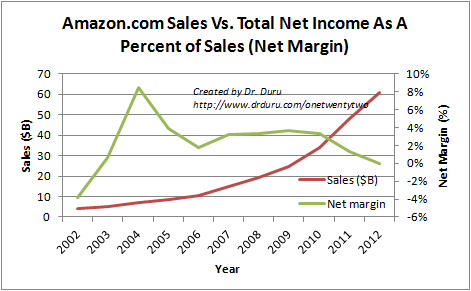

AMZN’s Q4 results caps another year with soaring revenue and declining net margins. {snip}

Source: MSN Money

I continue to find these divergent trends surprising for a stock trading around all-time highs at an equally lofty valuation. Clearly, investors and traders are betting on something to change far out in the future and are now willing to patiently wait for it. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 3, 2013. Click here to read the entire piece.)

Full disclosure: long AMZN calls and put spread