(This is an excerpt from an article I originally published on Seeking Alpha on February 8, 2013. Click here to read the entire piece.)

On February 7th, The Monetary Policy Committee (MPC) of the Bank of England (BoE) decided once again to peg interest rates at 0.5%. The projections and explanations for inflation most interested me about the policy statement. The BoE projects inflation to remain above the 2% target for the next two years (emphasis mine):

{snip}

So, despite these inflationary pressures, the BoE has decided to maintain ultra-low interest rates. The BoE has been quite consistent in its approach to managing policy around inflation targets. No matter what the explanation or trajectory of inflation, the BoE assumes that eventually inflation will return to target. This assumption relieves the BoE of the awful decision to increase rates to choke inflation only to risk further choking an already moribund economy.

However, the current presumed mechanism for containing inflation presents an economic conundrum. {snip}

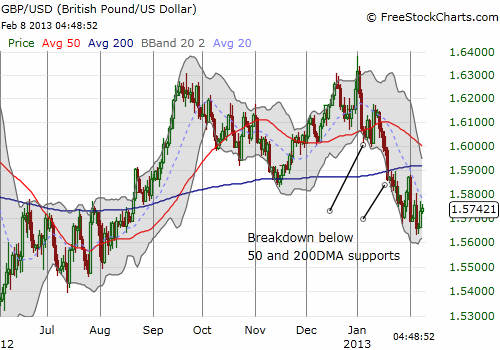

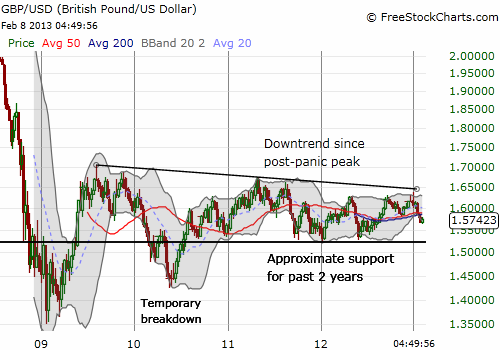

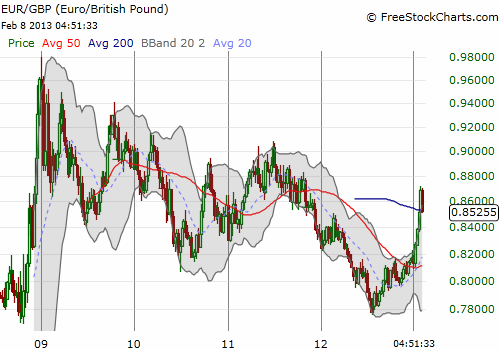

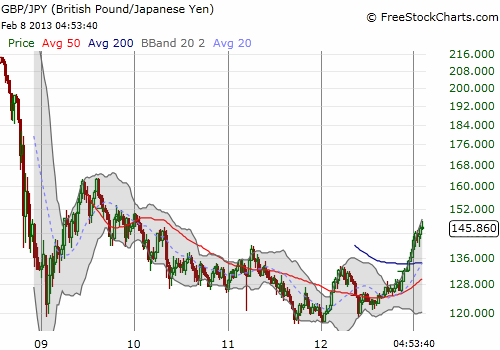

Source: FreeStockCharts.com

Adding to the UK’s economic conundrum is the stubborn persistence of weak economic growth (mainly flat) in parallel with strong employment growth. {sinp}

In conjunction with the latest statement on monetary policy, incoming BoE Governor Mark Carney provided testimony for almost four hours, discussing the UK economy and monetary policy. Overall, it seems nothing much will change at the BoE under his leadership. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 8, 2013. Click here to read the entire piece.)

Full disclosure: short GBP/USD