(This is an excerpt from an article I originally published on Seeking Alpha on December 26, 2012. Click here to read the entire piece.)

Most of the clues required for the British pound’s direction for 2013 are contained in the Bank of England’s last Inflation Report back on November 14, 2012. The British pound enjoyed a relatively strong 2012, and outgoing BoE Governor Mervyn King is not happy about it:

{snip}

The theme of driving the British pound lower came up again as King implied that such action may be the UK’s only option to achieve the economic rebalancing required to return to a health economy… {snip}

As this passage shows, King’s economic outlook is sombre, perhaps outright pessimistic. This notable change in tone was picked up by several reporters during the question and answer period. {snip}

{snip}

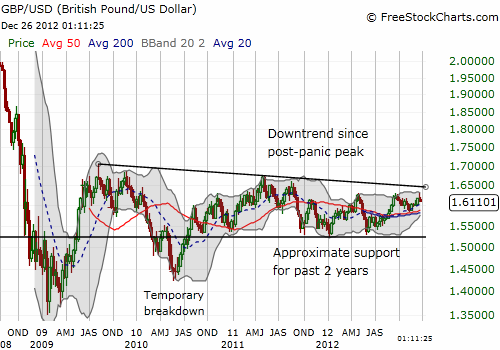

This theme of rebalancing is not new, especially for King. What seems different now is that King has clearly given up the last vestiges of hope that rebalancing will occur anytime soon. In doing so, he sees little wiggle room for the UK to expand its economy. Protracted economic weakness combined with the central bank’s claim that the currency is too high suggests to me that the British pound (FXB) is not likely to advance much further in 2013. {snip}

Source: FreeStockCharts.com

{snip}

While King would likely love to drive the British pound back down using monetary policy, presumably through more asset purchases, he acknowledges the limits to this strategy. He even seems to say that the UK is fast approaching the limit:

{snip}

This recognition suggests to me that the British pound likely has downside limited by the bottom of the approximate range shown above. In other words, 2013 promises more of the same for the British pound.

{snip}

As this dynamic plays out in 2013, the British pound may even get tagged a “safety currency” as traders and investors seek shelter from the forces of competitive devaluation. Those bouts of strength will offer occasions to go short as eventually the overall weakness of the UK economy should make the trade less and less attractive. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 26, 2012. Click here to read the entire piece.)

Full disclosure: no positions