(This is an excerpt from an article I originally published on Seeking Alpha on December 25, 2012. Click here to read the entire piece.)

In the summer of 2011, I started a series called the “Commodity Crash Playbook” designed to take advantage of the bargains created from what, at that time, seemed to be a coming collapse in commodity prices. {snip}

In the meantime, the potential damage of the Fiscal Cliff is much more immediate than a slowdown in China’s economy. {snip} With opportunity in mind, I am launching this series “Over the Fiscal Cliff Lies Opportunity Valley” as an investing meme. The first candidate investment is Saic, Inc. (SAI). It is actually a two-layered opportunity – first from the Fiscal Cliff and next from a proposed split of the company into a services business and a solutions business.

{snip}

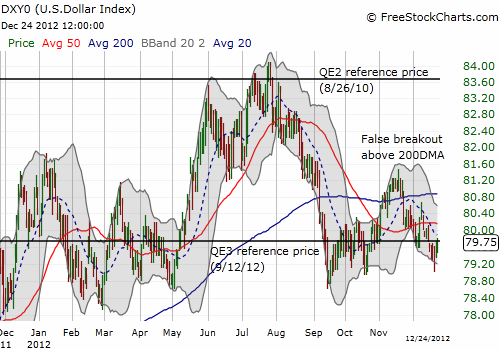

Source for charts: FreeStockCharts.com

No doubt hurting the stock is a stagnation in revenues over the last four (fiscal) years between $10 and $11B. {snip}

As part of its preparation, SAI has restructured its business to get more competitive and to reduce costs. {snip}

Most importantly, during the late August earnings conference call, SAI announced plans to split into two companies: a solutions company (“blueco”) and a services company (“whiteco”). {snip}

…In “You Can Be A Stock Market Genius,” author Joel Greenblatt explains how investors can profit from corporate splits…{snip}

There could be yet another kicker when the split occurs. SAI is a component of the S&P 500 (SPY). Greenblatt explains that institutional investors who only invest in components of the S&P 500 will be forced to dump whichever part of the split business gets dropped from the index (probably both). This artificial selling represents the second layer of the opportunity in SAI. {snip}

While the Fiscal Cliff is a government dynamic that could harm SAI in the short-term, SAI has a large opportunity to benefit from the implementation of ObamaCare. {snip}

As if all these accumulated goodies are not enough, SAI even offers a healthy dividend yield now at 4.2% thanks to the drop in the stock. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 25, 2012. Click here to read the entire piece.)

Full disclosure: no positions