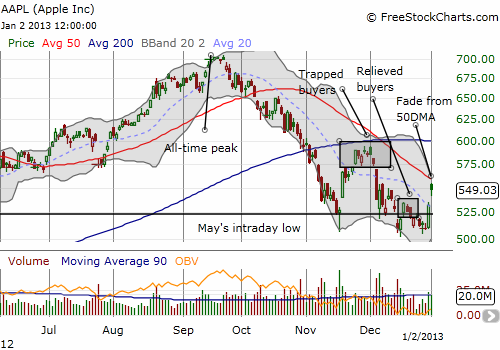

For the fist time in about a month, Apple (AAPL) is challenging its short-term downtrend, currently marked by the declining 50-day moving average (DMA).

Over the past two trading days, AAPL has surged 7.7%. The stock had gained as much as 8.9% at today’s high. This tremendous surge maintains AAPL’s tendency to begin the week strong (see “How To Trade Apple’s Breakdown As Negative Sentiment Grows” for the latest update on that pattern). The fade from resistance at the 50DMA sets up a (typical) weak close to the week, but today’s trading at least turned the trapped buyers who chased the last pop into relieved buyers. Given the meager trading volumes going into the latest rally, I suspect those buyers held firm. However, those buyers who chased Apple when it last challenged resistance at the downtrend (and 200DMA) are still waiting their vindication and relief.

Source: FreeStockCharts.com

While Apple is not likely to break its downtrend this week, the good news is that the latest buying has occurred on strong volume. This increases the likelihood that ~$500 will ultimately hold up as firm support (excluding any response from earnings news of course) despite my earlier concern that Apple would not find firm support until it filled the gap up from February, 2012 around $430.

Apple’s large swings have turned the method of alternating call/put spreads into a good trading strategy (again see “How To Trade Apple’s Breakdown As Negative Sentiment Grows” for more details). The biggest drawback to this strategy so far is the amount of money I have left on the table from not being able to magically time exits. For example, I sold a weekly Jan $540 call into Monday’s surge only to see today’s surge would have at least tripled the money. Sticking to the rules, I purchased a 530/515 put spread expiring next week that now compliments a Jan $580 call expiring on the regular monthly schedule (BEFORE AAPL reports earnings on January 23rd). I have nothing left in play for this week although I strongly suspect more big moves are coming.

Be careful out there!

Full disclosure: long AAPL shares and put and call spreads.