(This is an excerpt from an article I originally published on Seeking Alpha on November 28, 2012. Click here to read the entire piece.)

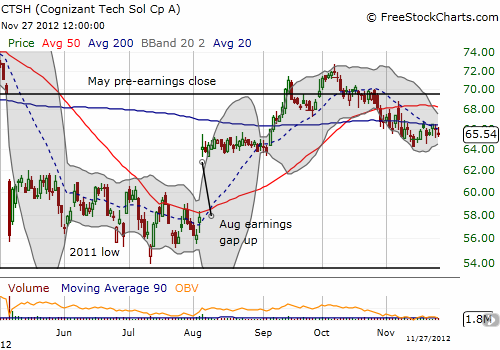

In late July, Cognizant Technology (CTSH) was consolidating after a steep post-earnings sell-off in May. At the time, I argued this marked an opportunity to start accumulating the shares (see “Planning To Accumulate Cognizant Technology Even As It Fights To Hold 2-Year Lows“). The trade paid off much faster than I expected once CTSH soared after its August earnings and soon ran up to its 200-day moving average. I decided to sell in anticipation of a pullback but instead CTSH went on to fill the May earnings gap.

Source: FreeStockCharts.com

{snip}

On Tuesday, November 27th, 4083 options contracts sold at the December $62.50 strike against open interest of only 431 contracts. {snip}

This bearish trade sticks out particularly given the relative benign, even bullish, options setup on CTSH before Tuesday’s trade. {snip}

In other words, the swell in put trading for near-month expiration stands in such stark contrast to all the other signals that it makes a lot of sense to sit up and take note. Depending on what news unfolds between now and the December options expiration, I will prepare for accumulating shares into a sell-off. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on November 28, 2012. Click here to read the entire piece.)

Full disclosure: no positions