(This is an excerpt from an article I originally published on Seeking Alpha on December 6, 2012. Click here to read the entire piece.)

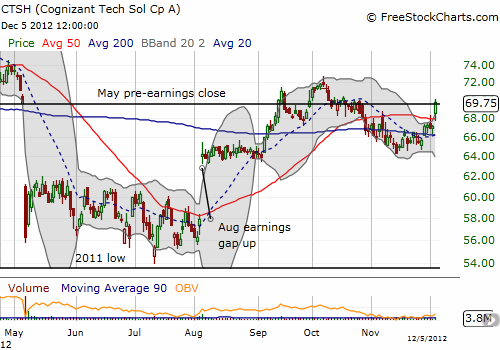

This is a quick follow-up to last week’s piece on Cognizant Technology (CTSH): “Cognizant Technology ‘On Watch’ For A Sell-Off Based On Put Option Volume.” At the time, I observed a surge in put volume at the December $62.50 strike and anticipated a coming buying opportunity. Instead of selling off, the stock has since broken out above both its 50-day and 200-day moving averages (DMAs), rallying 6.4%. Those puts have lost almost all their remaining value.

Source: FreeStockCharts.com

I have to assume now that some trader(s) anticipated Wednesday’s 8K release on executive compensation incentives tied to revenue targets that meet analyst expectations, SELLING puts for premium instead of looking for a huge downside payday.

{snip}

The options action continues to throw up mixed signals as put volume surged yet again despite the rally in CTSH. {snip}

The key lesson here – one that is good to learn and learn again – is that options volume is not always what it seems. {snip}

{snip} A close above the October high will be very bullish and suggest that the next rally in the shares is well underway. This becomes the more likely scenario given CTSH’s recent 8K release suggests that revenue expectations for 2013 are safe and sound.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 6, 2012. Click here to read the entire piece.)

Full disclosure: no positions