(This is an excerpt from an article I originally published on Seeking Alpha on November 6, 2012. Click here to read the entire piece.)

The timing of The Reserve Bank of Australia’s interest rate cuts is starting to look like a random number generator. In its latest statement on monetary policy (Nov 6th in Australia), the RBA decided to leave interest rates at 3.25% while essentially repeating the same assessments it has had for the last several meetings. The main difference was in the RBA’s assessment of inflation which printed hotter than expected last month…{snip}

The RBA balked at the inflation numbers and veered off the more accomodative course it seemed to set ahead of itself. The market’s disappointment was instant of course. {snip}

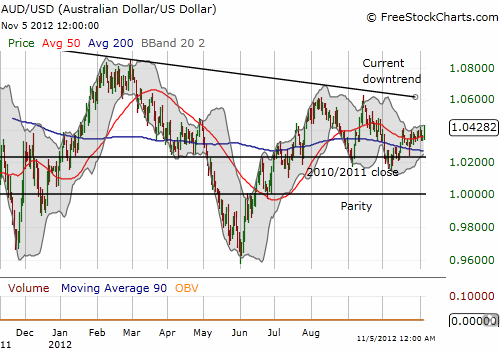

Source: FreeStockCharts.com

The RBA noted that its accomodative policies seem to be having an impact, but the RBA refrained from quantifying its satisfaction with what can be observed right now…

{snip}

The regularly scheduled reminder that the RBA believes the Australian dollar is higher than desired should serve as a reminder that the RBA is biased for action to do what it can to drive the currency lower. That bias continues to underline my bearish leanings against the Australian dollar.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on November 6, 2012. Click here to read the entire piece.)

Full disclosure: net short Australian dollar