(This is an excerpt from an article I originally published on Seeking Alpha on November 2, 2012. Click here to read the entire piece.)

This week featured two interesting speeches by Australian officials. On October 30, Philip Lowe, Deputy Governor for the Reserve Bank of Australia (RBA), gave a speech at the Commonwealth Bank Australasian Fixed Income Conference Dinner auspiciously titled “Australia and the World.” Two days later, Wayne Swan, Australia’s Deputy Prime Minister and Treasurer, delivered an speech titled “The Global Outlook, Fiscal Policy, and Two Versions of the Future” at the the 2012 Economic and Social Outlook Conference in Melbourne, Australia. Both speeches contained what I think are further signals that Australia will remain biased towards lowering interest rates as long as the recovery in global economies remains anemic and/or uncertain.

Lowe described the two key international economic developments that impact the Australian economy: robust growth in emerging economies, especially within its Asian trading partners; and the on-going debt pressures in most developed economies. {snip}

Lowe goes on to explain that the resulting “…contractionary effects of an appreciation can be countered with more stimulatory domestic policy-setting – including through lower interest rates – than would otherwise have been the case.” Lowe is justifying lowering rates by pointing to the need to relieve the upward pressure on the Australian dollar, pressure that would otherwise work to slow down Australia’s economy if not checked. This statement is one of the clearest examples I have seen that the RBA is targeting a lower Australian dollar by reducing interest rates.

Swan’s speech provides even more clarity on the government’s belief that plenty of room remains to the downside for interest rates in Australia… {snip}

{snip}

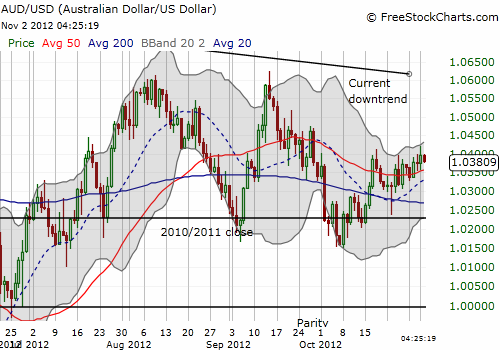

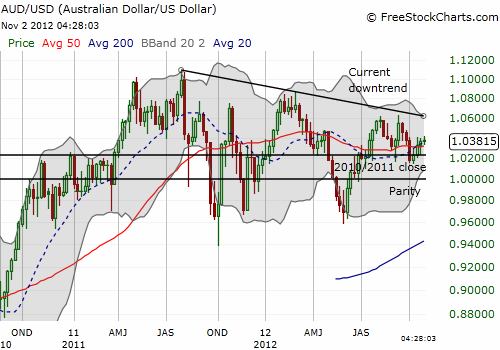

Since late 2010, the Australian dollar has traded within a wide band against the U.S. dollar.

Source for charts: FreeStockCharts.com

{snip}…if inflation numbers keep printing hotter than expected like last month’s CPI, this strategy may undergo significant dilution.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on November 2, 2012. Click here to read the entire piece.)

Full disclosure: net short Australian dollar