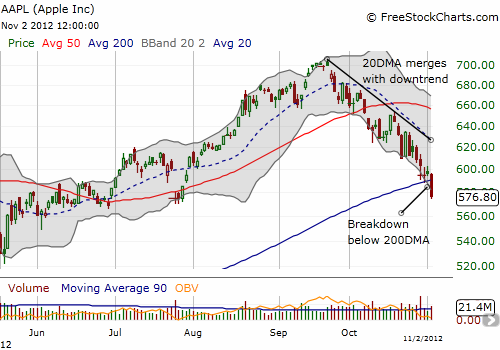

The 200-day moving average (DMA) has been Apple’s friend since the stock bounced from its March, 2009 lows. A break during June, 2011 was short-lived and the stock survived two more tests of this critical long-term support later that year. Starting in January of this year, Apple (AAPL) pulled sharply away from its 200DMA until April. Inevitably it seems, such large diverges cannot last forever. While AAPL eventually made fresh all-time highs five months later in mid-September, the 200DMA has finally caught up with AAPL in the middle of a short-term downtrend. After three days of flirting with its 200DMA support post-earnings, AAPL finally broke down on Friday.

Source: FreeStockCharts.com

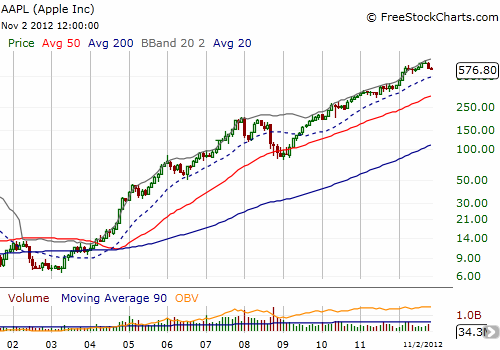

Apple’s breakdown is certainly weighing on the NASDAQ and generating the increasingly bearish outlook for the high-tech index. I added the monthly chart as a reminder of how easy it has been to be an AAPL bull over the last 10 years or so for those who have been willingly too stare across the horizon (I wish I was one of them!). In particular, since 2009, every Apple scare and sell-off has turned out to be a minor bump on the road. And so, it seems, the current breakdown is likely to be no different. According to a friend of mine, plenty of hope remains. With permission and some editing, I post below his latest email to me about Apple’s prospects:

The sell-off seems to be a reaction to “poor” first-day sales of the iPad Mini. I haven’t heard much about iPad 4 sales; maybe they’re also perceived as weak. It is hard to estimate how many customers would have bought one today but could not go to a store or get online because they’re still dealing with Sandy.

Of course if anyone else sold several million of $330 or $600 devices on their first day in stores their creators would be ecstatic, but expectations for Apple are higher, and particularly for the Mini they seem to be much higher than an understanding of its purpose supports.

Regarding the Mini, it was clear to me all along that the expectations of the analysts who thought Apple would produce a device to compete directly with Amazon’s (AMZN) Kindle were wrong. Apple designs premium devices. It does not design for a price point or to provide an Apple alternative to a specific other device, but rather to best meet a need. Unfortunately, Tim Cook did not make that very clear in the product launch, only later in the FY Q4 conference call, when he said that the Mini is for those who want a physically smaller iPad. That said, it remains to be seen how many customers will pay $330 for an iPad Mini. Ultimately, it may not be a popular product. But it will not be an abject failure (as, for example, every one of Microsoft’s (MSFT) phones has been). One cannot project any Apple product’s level of success from first-day sales.

Regarding the iPad 4, tear-downs indicate that Apple did not really get the most out of the interior real estate it freed up by moving to the smaller “Lightning” connector. To me this is another piece of evidence supporting the theory that Apple over-committed its internal resources in trying to release all these new devices in time for this year’s holiday buying season. They could have expanded the battery and/or speakers. No doubt iPad 5 will have better sound and/or sound.

Lest we get too depressed about those two new products, note that iPhone 5 is still supply-limited pretty much everywhere.

Here is what mega Apple bull Brian White from Topeka Capital Markets had to say in September about Apple’s major upgrade cycle as he noted consumers had been waiting 27 months for the arrival of the iPhone 5. He saw absolutely nothing in competitive products to derail his bullishness…

Now, White is noting that the iPad Mini seems to be popular in New York City despite the devastation of Hurricane Sandy. Here is a related quote from Barron‘s:

“Amidst ‘flared tempers’ over lines for gasoline in New York City, Dow Jones Newswires’s Drew Fitzgerald reports that ‘hundreds’ stood in line at Apple’s flagship store on Fifth Avenue and 59th Street to buy the device.

Topeka Capital Markets’s Brian White, who was at the store this morning, writes in a report this afternoon that all of both the white and the black flavor of iPad mini are sold out at the flagship store, an hour after the thing went on sale.”

Certainly, this holiday season will be a major pivot point for AAPL. In the meantime, the next firmest support for AAPL stock is around $523 where AAPL bottomed out in May AHEAD of the S&P 500’s bottom two weeks later. If there is indeed reason for hope, then a retest of those levels will become a MAJOR buying opportunity for AAPL stock. And if/once AAPL manages to close above the 200DMA and break the current short-term downtrend, then prepare for the next run-up.

(Read “Lessons Learned As Apple Earnings Deliver Dream For Options Sellers” for my review of lessons learned from trading Apple’s last earnings call)

Stay tuned and be careful out there!

Full disclosure: long AAPL, AMZN