(This is an excerpt from an article I originally published on Seeking Alpha on October 10, 2012. Click here to read the entire piece.)

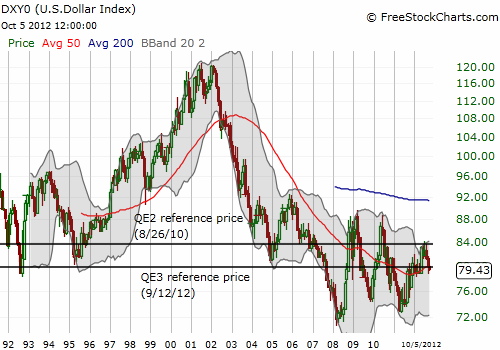

The financial crisis of 2008/2009 ended a long-term downtrend in the U.S. dollar (UUP). Ever since then, the Federal Reserve has been unable to grease the skids sufficiently to get this trend to resume.

{snip}

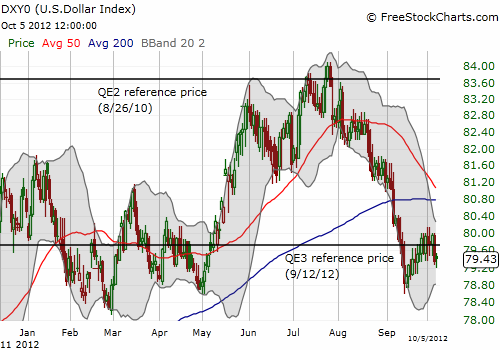

After the Federal Reserve announced QE3, the U.S. dollar dropped for two straight days. It has meandered higher ever since, even recovering all its post-QE3 losses.

Note that the dollar index is still below its 50 and 200-day moving averages (DMAs). I have shown in previous posts the importance of the 200DMA in determining the dollar’s next likely direction. In this case, the odds favor a much lower dollar in the coming weeks.

However, understanding how the dollar will decline is quite tricky. {snip}

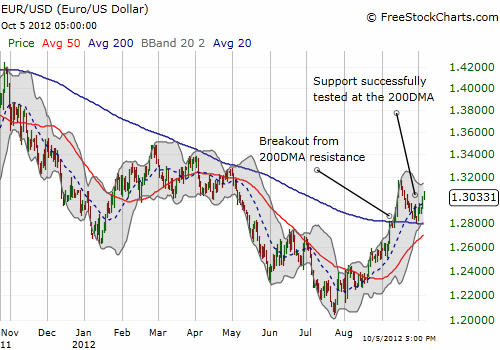

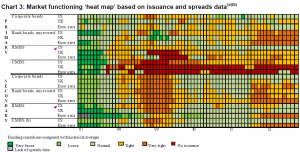

{snip}…The chart is a heatmap showing the locus of financial stress in primary and secondary bond markets in the U.S., the euro area, and the United Kingdom from 2007 to 2012. The U.S. is faring much better than the euro area where conditions are tight almost across the board. This means there is a natural force pointing in favor of U.S. dollars over euros. In a sense, this relative demand for U.S. dollars (especially as a reserve currency) allows the Federal Reserve room to print.

Click for a larger view…

The Bank of England’s Sources: Bloomberg, Dealogic, JP Morgan Chase & Co., Bank of America Merrill Lynch and Bank calculations.

{snip}

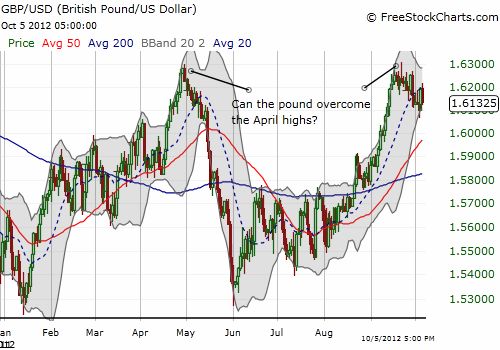

Financial stresses also remain relatively high in the United Kingdom as a function of the recessionary economy there and spill-over impacts from the stresses in the eurozone. {snip}

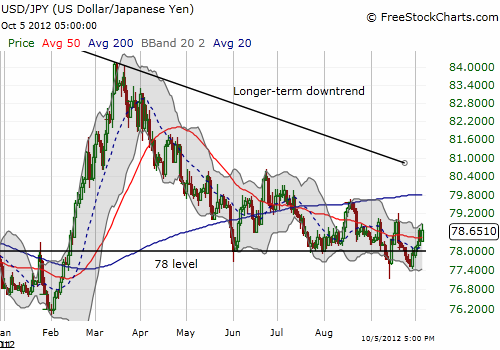

{snip}…the yen’s contribution to a lower dollar seems tightly capped. {snip}

{snip}

Finally, the announcement of QE3 still marks the 52-week and near 5-year high in the S&P 500 (SPY). The stock market is almost behaving as if it will need the dollar to resume its descent to regain/sustain upward momentum…{snip}

Source for charts: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 10, 2012. Click here to read the entire piece.)

Full disclosure: no positions