(This is an excerpt from an article I originally published on Seeking Alpha on October 21, 2012. Click here to read the entire piece.)

{snip} Since at least 2010, Governor Mark Carney has consistently warned Canadians that interest rates are abnormally low and must inevitably go up. However, Carney has also made it clear that Canadian monetary policy cannot diverge too far from that in the U.S. {snip}

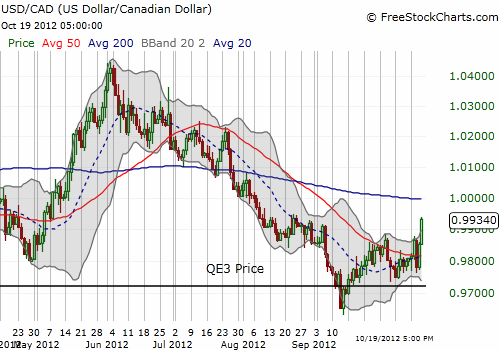

…the Canadian dollar (FXC) experienced a wild week of swings…{snip}

My eyes are more focused on the Canadian dollar now because it could be an indicator of how well the U.S. dollar will fare relative to its QE3 price (its level right before the announcement of QE3). Along with its cousin commodity currency the Australian dollar (FXA), the Canadian dollar lost its QE3 gains in just two trading days after the Federal Reserve announced QE3 in mid-September. {snip}

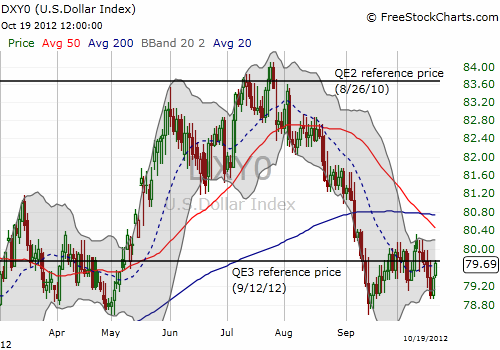

In the meantime, the U.S. dollar (UUP) has returned to its QE3 price. {snip}

Source for charts: FreeStockCharts.com

Carney’s speech that launched the wild week for the Canadian dollar was notable for its warnings and encouragement for Canadians. {snip}

Even more ominous, Carney reminded those who will listen that some volatility increasing event is almost certain to happen (soon?). {snip}

These warnings are consistent with Carney’s frequent admonitions to Canadians to avoid complacency.

{snip}

Although the immediate response to QE3 cuts against expectations, Carney notes that Canadians will eventually benefit from QE3:

{snip}

I will continue to look for opportunities to invest in Canada as outlined last year. A volatility-inducing event may produce just the right bargains to further build out the Canadian portion of the portfolio.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 21, 2012. Click here to read the entire piece.)

Full disclosure: long USD/CAD