(This is an excerpt from an article I originally published on Seeking Alpha on September 14, 2012. Click here to read the entire piece.)

In the Federal Reserve’s latest statement on monetary policy, Chairman Ben Bernanke basically announced that the Fed is giving the economy a blank check:

{snip}

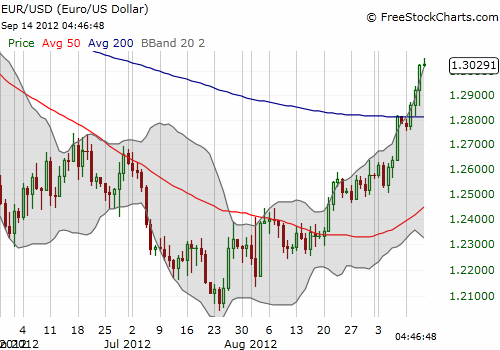

This forceful action is likely much stronger than already anticipated by the dollar index’s (UUP) roughly 5.5% slide from recent highs in July.

It is tempting to believe that the Fed’s blank check equates to a bottomless pit for the dollar. If the economy never responds to all the asset purchases, or any other attempt to rev it up, then perhaps the Fed could grind the dollar into complete powder. However, I think that at some point soon the financial markets will stabilize the dollar….{snip}

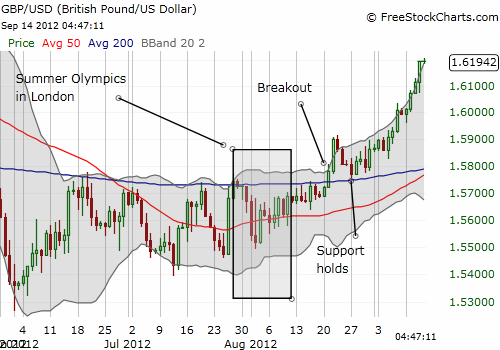

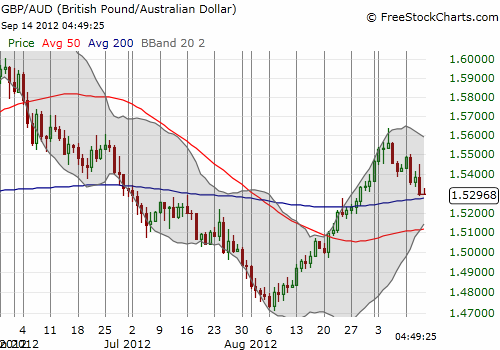

In the case of the pound, GBP/USD has followed through nicely on the bullish case I laid out in late August against the dollar but not against the Australian dollar (FXA). {snip}

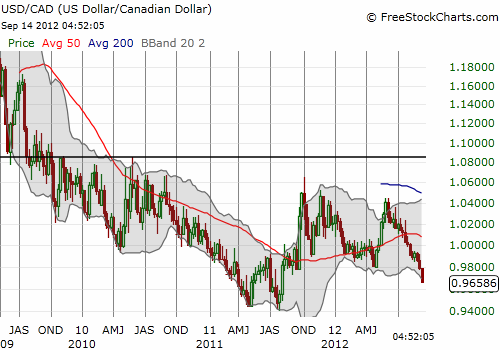

For going long the dollar, I now prefer to play the Canadian dollar (FXC). {snip}

Instead of continuing to short the U.S. dollar, I think the next great opportunity is likely in shorting the Japanese yen (FXY). {snip}

Azuni has tried to jawbone the currency lower to no avail and will likely be forced to act to intervene. The timing of such intervention is of course quite uncertain. {snip}

Source for charts: FreeStockCharts.com

{snip}

Be careful out there!

Video streaming by Ustream

Source: Federal Reserve UStream

(This is an excerpt from an article I originally published on Seeking Alpha on September 14, 2012. Click here to read the entire piece.)

Full disclosure: long USD/CAD, long GBP/AUD