(This is an excerpt from an article I originally published on Seeking Alpha on September 14, 2012. Click here to read the entire piece.)

The Swiss National Bank (SNB) struck a very dour note in its latest statement on monetary policy. Blaming in part the continued over-valuation of the Swiss Franc (FXF) – “the Swiss franc is still high and is weighing on the Swiss economy” – the SNB lowered its expectations for GDP growth and inflation. Moreover, it warned that “Downside risks to the Swiss economy will also stay high in the near term.” The SNB accentuated its dour tone with a gloomy review of global economic performance in the second quarter:

{snip}

In what I think is a new twist, the SNB also acknowledged that its booming residential real estate market threatens the stability of its financial system. {snip}

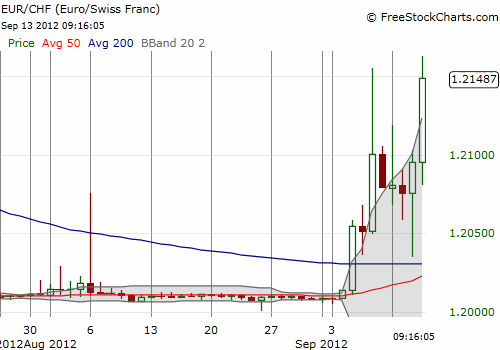

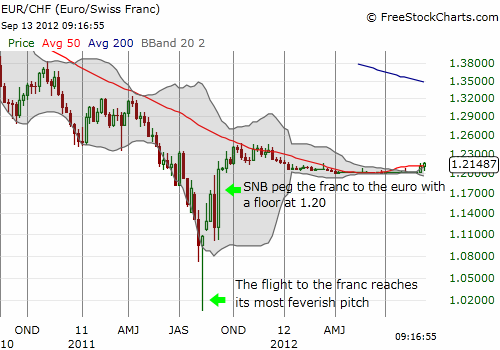

With the Swiss franc finally losing a bit of ground to the euro (FXE), it appears the market is finally starting to accept that the franc is over-valued. {snip}

The following charts show a close-up and overall look at the EUR/CHF currency pair.

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 14, 2012. Click here to read the entire piece.)

Full disclosure: no positions