(This is an excerpt from an article I originally published on Seeking Alpha on August 26, 2012. Click here to read the entire piece.)

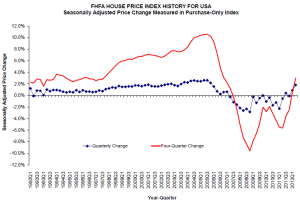

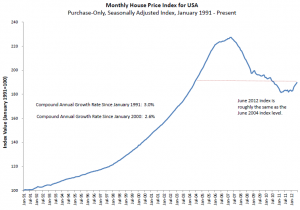

The last earnings reports from homebuilders like Toll Brothers (TOL) and KB Home (KBH) have delivered very positive outlooks on the current housing market: see “A Swell Of Pent Up Demand Supports The Surge In Toll Brothers” and “KB Home Going ‘On Offense’ As Its Housing Markets And Pricing Power Strengthen.” The latest housing price data from the Federal Housing Finance Agency (FHFA), released August 23, seem to corroborate this bullishness. The FHFA report shows what looks like a firming in pricing power for sellers. If this bottoming in prices is sustained, then the housing market is well on target for the bottom in 2013 that I have anticipated since 2009 (for example, see 2010 article “Still Expecting Housing to Bounce Along the Bottom Until 2013“).

{snip}

Click charts for larger views…

(Download data here)

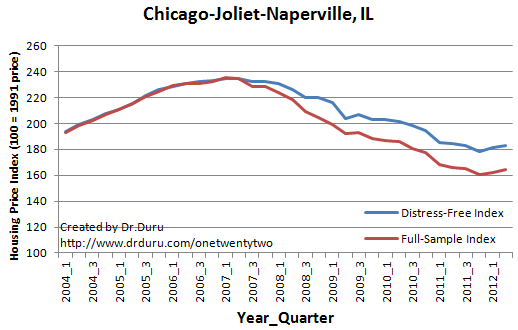

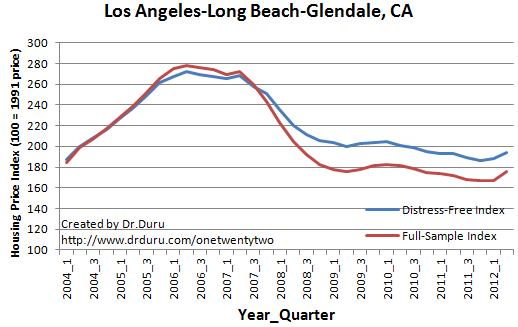

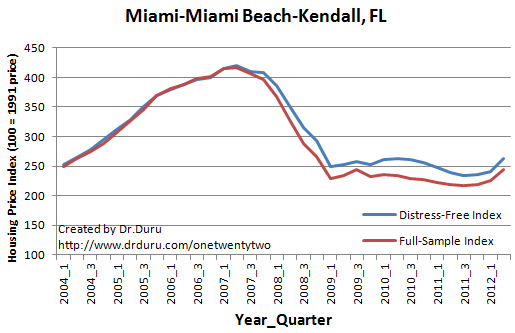

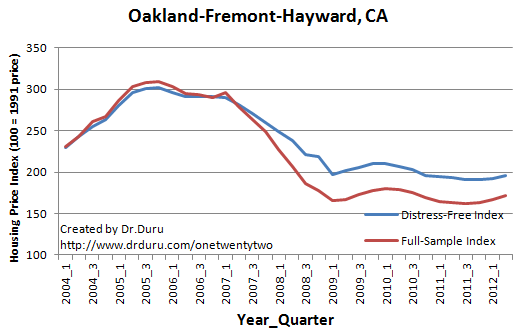

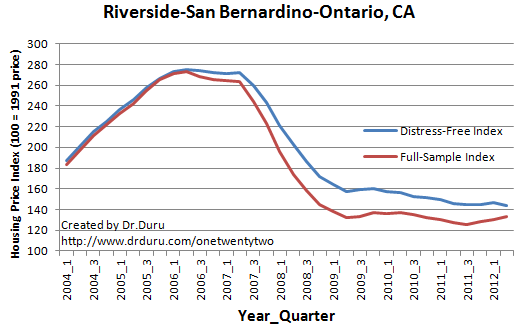

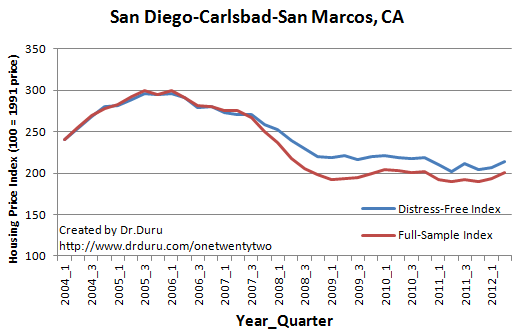

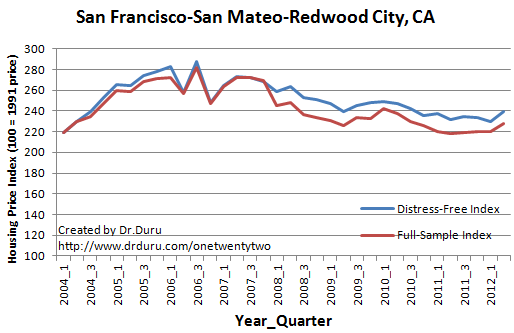

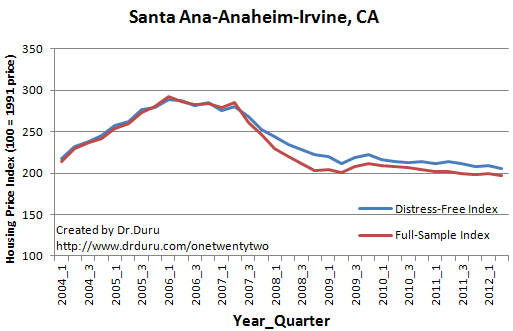

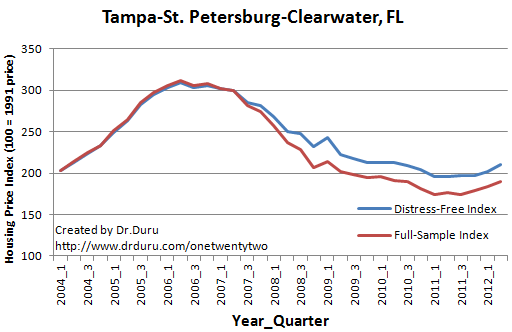

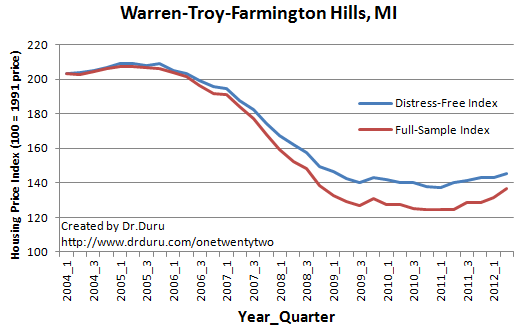

The FHFA also released its new “distress-free” measures for the purchase-only HPI. {snip}

{snip}

I like this measure because it can provide more supporting evidence for the sustainability in price changes. For example, if the distress free HPI is bottoming along with the full sample, then I can assume that distressed homes are having a lower impact on pricing. {snip}

In almost all the twelve metropolitan areas studied by the FHFA, the bottoming of prices seems as clear as the overall price index shown above. {snip}

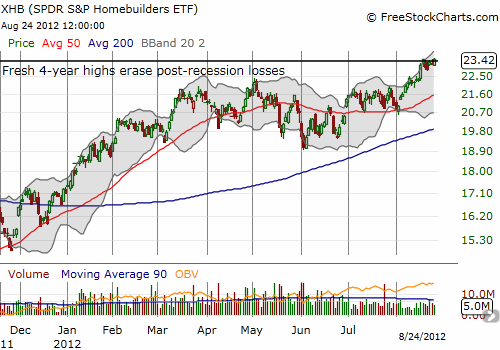

Housing-related stocks have traded higher ahead of these data. {snip}

Source: FreeStockCharts.com

Now, with homebuilder stocks at multi-year highs, I think the current budding recovery is now fairly priced into related stocks. Buying dips still makes sense and corrections are likely to occur anytime the data show setbacks in the recovery. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 26, 2012. Click here to read the entire piece.)

Full disclosure: long KBH shares and short calls