(This is an excerpt from an article I originally published on Seeking Alpha on August 19, 2012. Click here to read the entire piece.)

In 2010, the SPDR S&P Homebuilders ETF (XHB) rallied sharply only to peak in parabolic fashion in April. That Fall, I reaffirmed my belief that housing would bounce along the bottom until 2013. The next rally started from the August lows and ran until a peak in early May, 2011 that failed to surpass 2010’s high. As the next sell-off unfolded, fear grew that the housing market could sink into an even greater depression. The third time could be a charm. THIS year, XHB managed to survive the latest europanic-driven swoon with minimal losses. On Friday, the rally from last year’s lows continued with a fresh four-year high, essentially erasing all its post-recession losses.

{snip}

{snip}

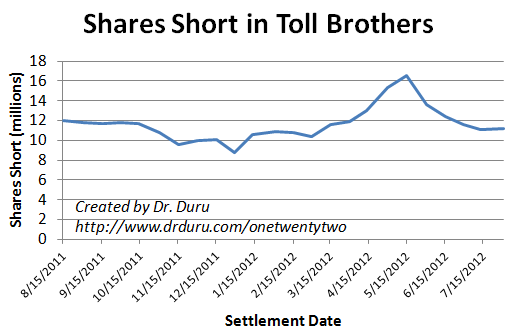

Source: NASDAQ short interest

Shorts could be taking heed to commentary like the one from Pulte Homes (PHM)…{snip}

{snip}

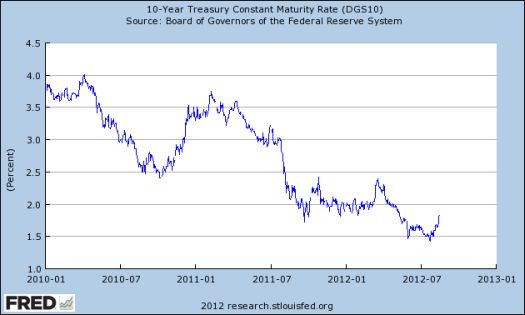

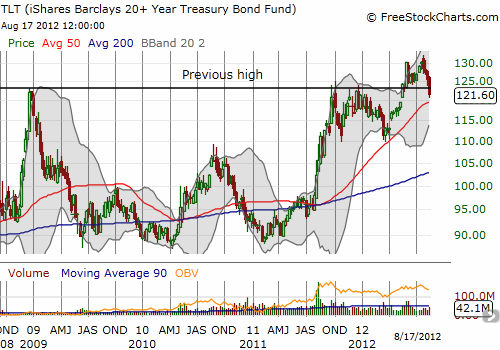

So, if shorts start showing a new respect for the nascent housing recovery, what about bond buyers? {snip}

Source: Federal Reserve Bank of St. Louis

{snip}

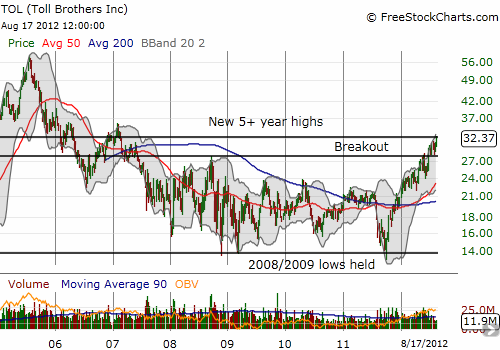

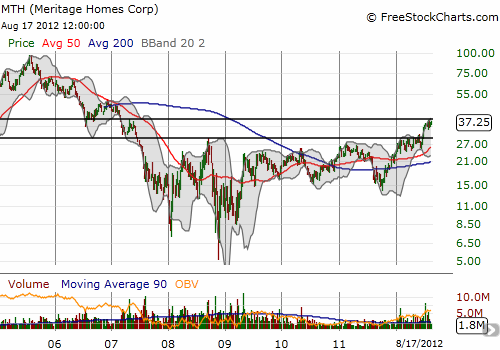

Source: FreeStockCharts.com

I also decided to sell calls against my shares in KBH. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 19, 2012. Click here to read the entire piece.)

Full disclosure (at the time of writing): long KBH shares, short KBH calls, long TLT calls, long TBT