(This is an excerpt from an article I originally published on Seeking Alpha on August 30, 2012. Click here to read the entire piece.)

When I wrote “Wide Options Skew Heightens Risks Of Trading Yelp.com Lockup Expiration,” my main point was that Yelp.com (YELP) put options seemed too expensive to take the risk of playing the potential downside impact of YELP’s lock-up expiration. A fake-out opening drop of 4.2% soon followed by a 22.7% close was definitely not on my radar. Trading volume was a YELP record of 8.8M shares (excluding the first day of trading) but nowhere close to the 52.7M shares that insiders can now sell. So it seems insiders generally decided to skip the cash register and hold onto their shares, and shorts had little choice but to rush for the exits (shorts were 21.8% of float as of August 15, 2012).

Now that the stock has soared so high, THIS is the time to consider placing bearish trades. {snip}

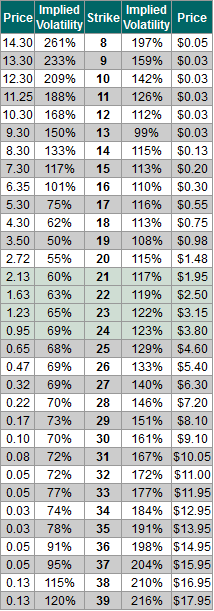

Chart of Implied Volatilities for YELP September options

Source: Schaeffer’s Investment Research

{snip}

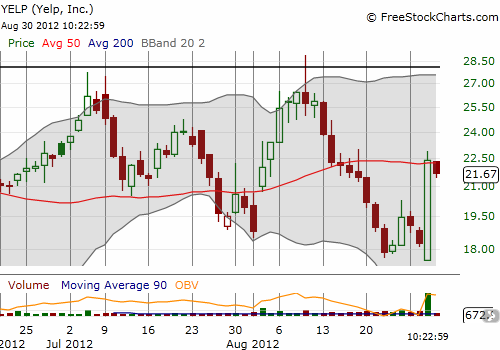

So, overall, I do not expect YELP to be able to hold current levels, even if the general stock market manages to rally from here. The triple top in YELP is extremely compelling, and it keeps me biased toward fading rallies in YELP.

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 30, 2012. Click here to read the entire piece.)

Full disclosure: long and short YELP puts