(This is an excerpt from an article I originally published on Seeking Alpha on August 27, 2012. Click here to read the entire piece.)

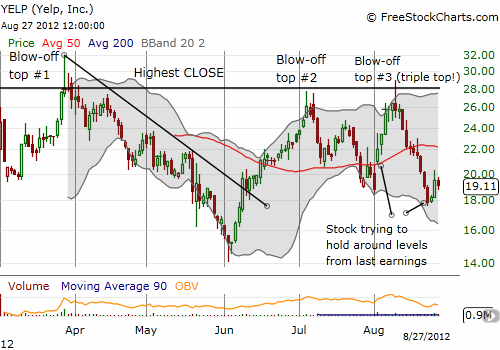

Yelp.com (YELP) has a float of 16.59M shares and shares outstanding of 61.2M. According to Eric Savitz, 52.7M shares (Class B) are available to start trading on August 29th as Yelp’s IPO 190-day lockup expires, representing a potentially tremendous flood of shares for the market to swallow. Interestingly, SEC filings show that shareholders only sold 50,000 of the 7.15M shares offered (Savitz claims none). So it is very possible YELP insiders have built up a lot of pent-up interest in selling, especially with the stock market testing multi-year highs and YELP dropping precipitously three times from the stocks’s highest close.

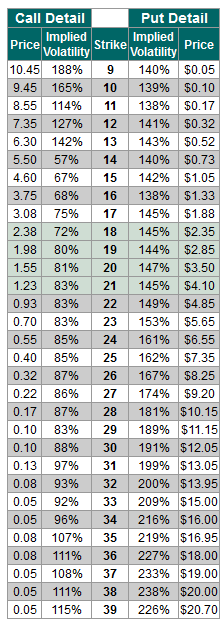

Options prices on YELP clearly show the heavy expectation toward additional downside in the wake of this lock-up. {snip}

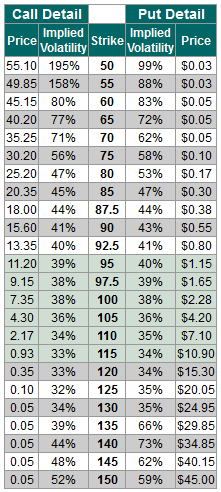

For comparison, here are the implied volatilities of Linked.com (LNKD).. {snip}

Source for tables: Schaeffers Investment Research

{snip}

Of the options available now, I would prefer to buy put spreads (these nullify much of the extremes in premium) or to short the stock immediately ahead of the event and look to close out the position soon after. {snip}

{sip}

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 27, 2012. Click here to read the entire piece.)

Full disclosure: no positions