(This is an excerpt from an article I originally published on Seeking Alpha on August 23, 2012. Click here to read the entire piece.)

The minutes from the last Federal Reserve meeting seem to suggest that members are starting to coalesce around Janet Yellen’s analysis that monetary policy should be more accomodative (see “Yellen’s Case for More Easing Primes Fed to Act Sooner Than Later“). While I have been expecting such a thing, I was completely surprised that minutes from the meeting could spark as big a response as it did in financial markets. I am assuming that the following sentence packed the most powerful punch:

“Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery.”

While we never know how many is “many,” this statement is a much more aggressive tone than the standard policy reminders that the Fed remains ready to act if economic conditions worsen. {snip}

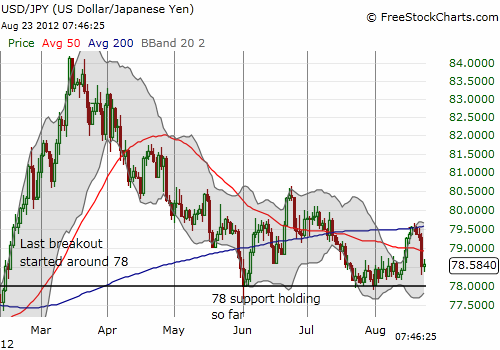

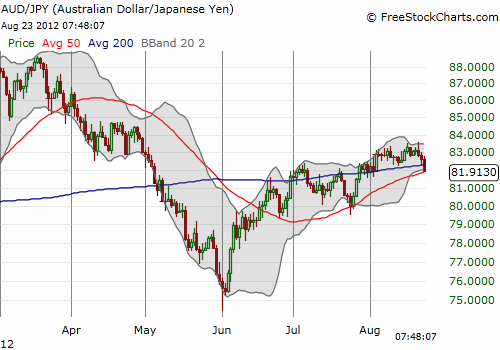

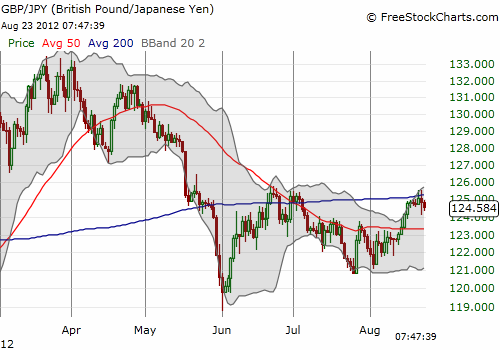

{snip} If market participants are increasing the odds of a weaker U.S. dollar, then anyone seeking safety will have to look elsewhere. That elsewhere is likely the Japanese yen. Indeed, the yen surged against most major currencies in the wake of the minutes release.

{snip}

Source: FreeStockCharts.com

The recent weakness in the yen seemed to be in anticipation of a poor economic report on Japanese exports. {snip}

{snip} Anything Azumi does right now will surely get completely nullified by the Federal Reserve later. The currency wars continue…!

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 23, 2012. Click here to read the entire piece.)

Full disclosure: long GLD, SLV; short EUR/AUD