(This is an excerpt from an article I originally published on Seeking Alpha on June 15, 2012. Click here to read the entire piece.)

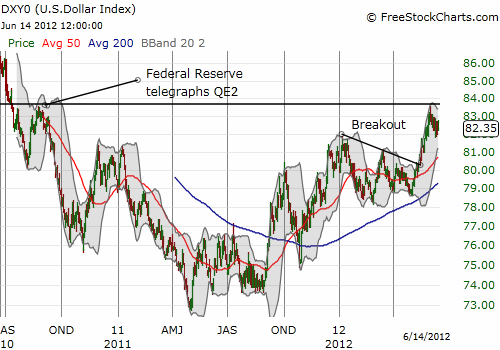

{snip}…I decided to summarize the last two speeches from U.S. Federal Reserve Vice Chair Janet L. Yellen given her strong advocacy for pro-active intervention on behalf of the U.S. economy…{snip}… I expect any action to increase liquidity in global financial markets will heavily rely on increasing the availability (or even supply) of U.S. dollars.

{snip}

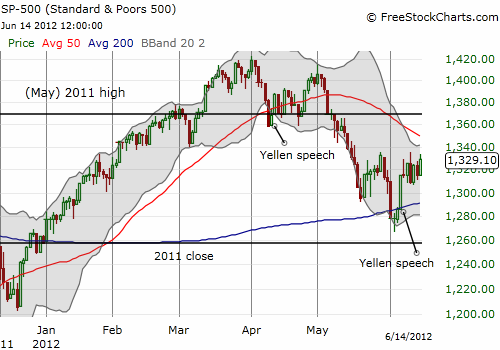

Source: FreeStockCharts.com

{snip}

In fact, Yellen insists that today’s accomodative policy is not loose enough, especially because of the constraint of the zero lower bound on (nominal) rates:

{snip}

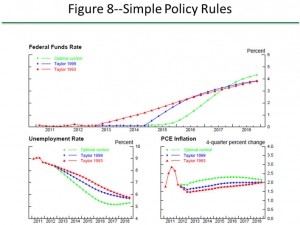

Yellen’s speeches fascinate me because she describes in explicit, technical detail the specific machinery she uses to assess options for monetary policy…{snip}

Click image for a larger view:

Source: The Economic Outlook and Monetary Policy

Yellen’s attraction to the optimal control policy comes out of her concern, shared by Chair Ben Bernanke, that persistently high unemployment will eventually lead to long-term structural unemployment. {snip}

{snip}

{snip} Yellen cautioned that to-date economic forecasters have been overly optimistic about the strength of the recovery, and she worries that forecasts are once again too high. She also appeared more insistent on the need for further monetary action. She indicated that the balance of risks pointed toward a weaker economy and “…that a highly accommodative monetary policy will be needed for quite some time to help the economy mend.”

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 15, 2012. Click here to read the entire piece.)

Full disclosure: net short U.S. dollar, long SDS