(This is an excerpt from an article I originally published on Seeking Alpha on July 23, 2012. Click here to read the entire piece.)

Japanese Finance Minister Jun Azumi has formed a habit of warning currency markets about the strength in the Japanese yen (FXY). For example, on May 31st, with USD/JPY slightly above 78 and at 3 1/2 month lows, Bloomberg reported the following warning from Azumi:

{snip}

The Japanese yen hit a bottom against the U.S. dollar the next day. Unfortunately for Azumi, just six weeks later these levels are getting retested. {snip}

Almost on cue, Azumi issued another warning about the yen’s strength last Tuesday, July 17th: {snip} However, this time, almost a week later, the yen has continued to gain against all major currencies.

Moreover, it is not so easy to claim that the yen is gaining from safe-haven buying. {snip}

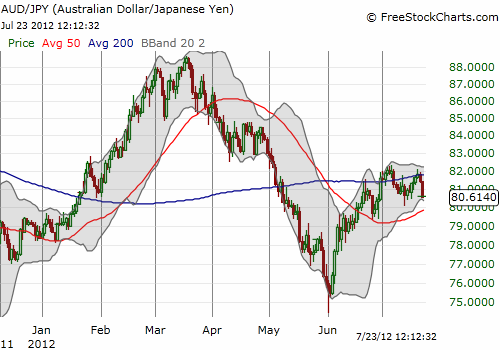

Source: FreeStockCharts.com

The Australian dollar’s rise against the yen has stalled out for much of this month. Perhaps the resumption of a downtrend in this currency pair could signal an imminent move to intervene on behalf of the yen.

{snip}

All things considered, I do not expect the yen to spend much time below 78 with the USD/JPY pair. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 23, 2012. Click here to read the entire piece.)

Full disclosure: net short Japanese yen, net short Australian dollar