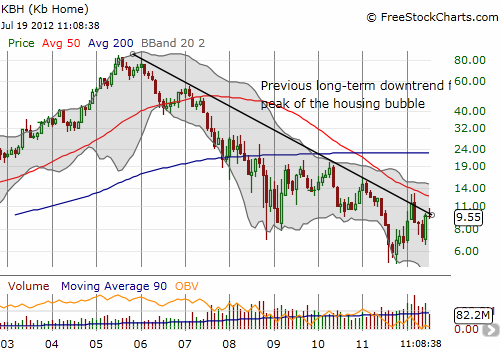

I have written positively several times about Kb Home (KBH) this year (for example, see “KB Home ‘On Offense’ As Its Housing Markets And Pricing Power Strengthen“). KBH is up nicely for the year through a lot of turbulent price action, but it has yet to shake its former downtrend drawn from the peak of the housing bubble through last year.

This chart shows a close-up of the action for 2012. Note how KBH failed on a breakout earlier this year to its highs for 2012. It is now struggling to break away from the former downtrend again.

Source: FreeStockCharts.com

So, despite improving financial results, KBH is not in the clear until it beats these bearish technicals. What makes these bearish technicals even more of a concern is that other homebuilders are doing much better right now. At the end of May, I wrote “KB Home Falls Further Behind The Homebuilders ETF.” Almost two months later, little has changed even as homebuilders like Toll Brothers (TOL) and D.R. Horton (DHI) are hitting five-year highs and better! At some point, I do expect KBH to catch up again, making the stock a great “value” play amongst homebuilders. Until that point, I expect more extreme volatility in price performance.

Be careful out there!

Full disclosure: long KBH