(This is an excerpt from an article I originally published on Seeking Alpha on June 29, 2012. Click here to read the entire piece.)

On June 27, 2012, Nightly Business Report interviewed Dennis Lockhart, President of the Atlanta Federal Reserve about the U.S. economy. During the interview, Lockhart indicated that the economic anecdotes he hears indicate conditions are better than the data show, so he sees no reason to pull out the “big guns” of monetary policy. However, QE3, a third round of quantitative easing, remains an option if the unemployment rate worsens and/or prices head into disinflation or deflation similar to what happened in 2010.

{snip}

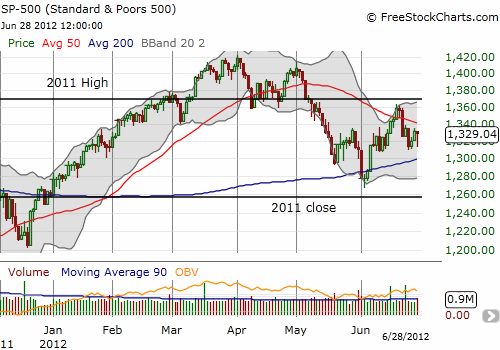

This interview was interesting because it held out the expectation of imminently better economic data along with the promise of further monetary easing if conditions do worsen. This interview was yet another reminder that the Federal Reserve is ready to roll out more easing if necessary (also see “Yellen’s Case For More Easing Primes Fed To Act Sooner Than Later“). This polarity is also a great metaphor for a stock market that has traded in a waiting pattern since early May.

Source: FreeStockCharts.com

The upcoming July earnings season will likely provide a turning point, up or down, but the poor performance of material and industrial stocks (cyclicals) has me extremely wary of what is to come.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 29, 2012. Click here to read the entire piece.)

Full disclosure: long SDS and SSO shares (shorter-term trade)