(This is an excerpt from an article I originally published on Seeking Alpha on July 3, 2012. Click here to read the entire piece.)

In keeping interest rates at 3.50%, the Reserve Bank of Australia (RBA) issued a relatively mundane statement on monetary policy on July 3rd. This statement contained many of the same themes from earlier statements, but, as expected, the RBA did not open the door wide open for more rate cuts. Instead, the RBA chose words of caution:

{snip}

In other words, the RBA is looking beyond its borders and preparing for a world much less supportive of Australia’s commodity-driven boom. However, its forecast for on-target inflation still compels a hold on further rate cuts.

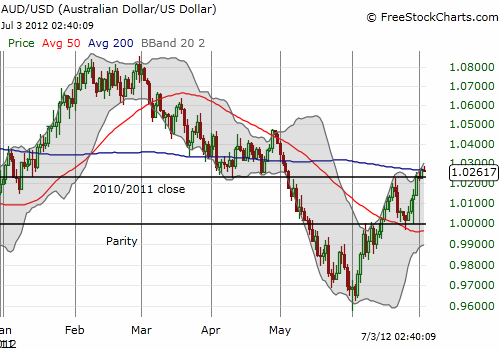

Also as expected, the RBA reminded us that “the exchange rate…overall remains high.” {snip}

Source: FreeStockCharts.com

The large caveat to my bearish outlook for the Australian dollar is my projection for the second half the year for the U.S. stock market; at some point, the market should experience at least one more large rally. {snip} If so, it is hard to imagine such a rally without the Australian dollar following suit: the currency continues to experience strong positive correlations with the S&P 500 (SPY). {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 3, 2012. Click here to read the entire piece.)

Full disclosure: net short Australian dollar