(This is an excerpt from an article I originally published on Seeking Alpha on June 4, 2012. Click here to read the entire piece.)

I have followed the Bank of England’s quarterly Inflation Report since November, 2009 as a way to gain insight into the UK economy and the prospects for the British pound (FXB). The latest report was released on May 16, and it contained some notable perspectives I have not noticed in previous reports on inflation, the currency, and economic output. Extended commentary on the need for economic rebalancing in global economies builds upon familiar themes and warnings and has taken an even greater urgency given the on-going sovereign debt crisis in Europe. This Inflation Report left me once again with the impression that British pound (or sterling) has little to no chance in the near-future to sustain any across-the-board appreciation and nor (re-)achieve “safety currency” status.

I think this was the first occasion in which Bank of England (BoE) officials admitted that the higher rate of inflation has surprised them because historical relationships did not repeat themselves as expected. {snip} The BoE believes that futures prices on gasoline indicate relief is on its way for the take-home pay of British consumers, but reporters in the audience sounded understandably skeptical. The BoE has promised relief around the corner many times before.

Despite the currency’s contribution to inflation, the BoE sees this dynamic as a necessary evil in accomplishing a rebalancing of the economy away from domestic demand and toward more exports. {snip}…

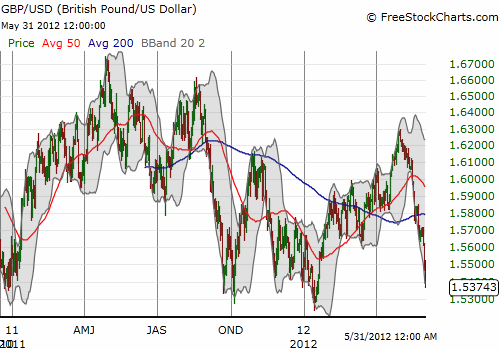

Source: FreeStockCharts.com

Governor Mervyn King as been one of the most ardent promoters of the need for rebalancing within the United Kingdom and across the global economy. In answering a report’s question, he took one more opportunity to complain about events in the eurozone…

{snip}

(This is an excerpt from an article I originally published on Seeking Alpha on June 4, 2012. Click here to read the entire piece.)

Full disclosure: short GBP/JPY, EUR/GBP; long GBP/AUD