(This is an excerpt from an article I originally published on Seeking Alpha on May 29, 2012. Click here to read the entire piece.)

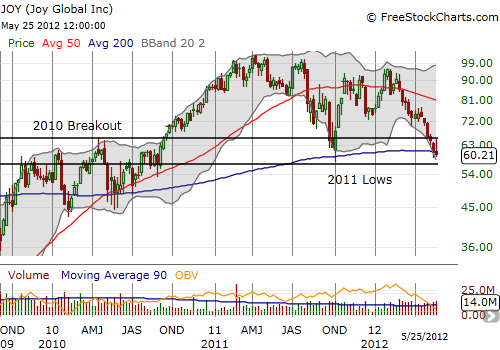

{snip} JOY reports earnings on the morning of May 31st with its stock struggling to stay above 2011 lows. The weekly chart shows how for a second time JOY has lost its gains from the important breakout in late 2010. The daily chart shows how this line has recently turned into resistance as the stock hovers above the 2011 lows.

Every earnings play I examine presents some interesting quirk that catches my attention. In the case of JOY, it is the combination of a likely retest of the 2011 lows, the general malaise in commodity-related stocks, and especially the extremely large swings in the stock last week. On May 21, JOY soared 6.5% only to lose all those gains by the end of the week. With a week to go before earnings, this tells me there is high potential for a very big move. {May 30th update: the stock has soared and dropped yet again, this time over just two days}.

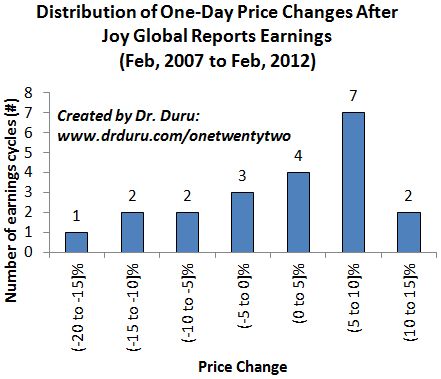

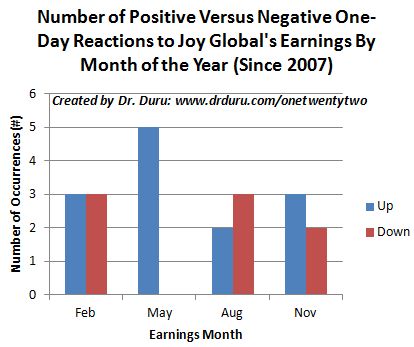

The historical record suggests that JOY is likely to have a positive (one-day) reaction to earnings. This record is not as compelling as other earnings plays I have analyzed…{snip}

Source: Earnings dates from briefing.com, stock prices from Yahoo!Finance

{snip} The one-day post-earnings gains have ranged from 1.4% to 9.7%.

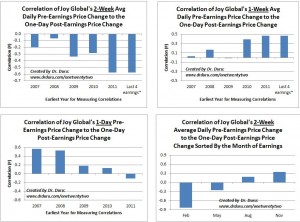

Before getting excited about any one particular data point, I like to see confirming signals. Unfortunately, in the case of JOY, almost none of my standard correlations are particularly strong. {snip}

Click for a larger view of the various correlation charts…

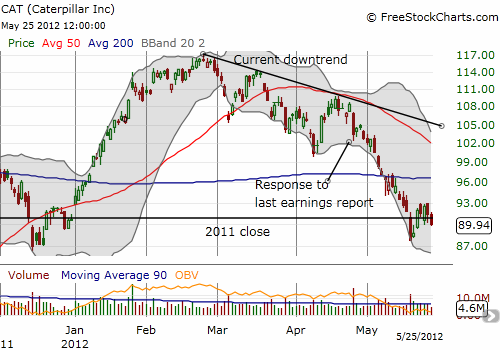

Since earnings for Caterpillar (CAT) always preceded Joy Global’s earnings, I next wondered whether CAT provides any clues on what to expect out of JOY. {snip}

Source for charts: FreeStockCharts.com

{snip} It turns out that JOY’s post-earnings response is not correlated with the response to CAT’s earnings. {snip} Since 2007, of the seven times CAT has traded down the day following earnings, JOY has experienced a positive one-day response six times after it reports earnings weeks later.

Thus, overall, JOY presents a very intriguing post-earnings play. {snip}

While I like the odds for an upside response, I consider the downside risk high enough to want to hedge bets. {snip}

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 29, 2012. Click here to read the entire piece.)

Long: CAT (left-over from earlier hedging)