(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 35%

VIX Status: 19.9%

General (Short-term) Trading Call: Hold. (click here for a trading summary posted on twitter)

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar)

Commentary

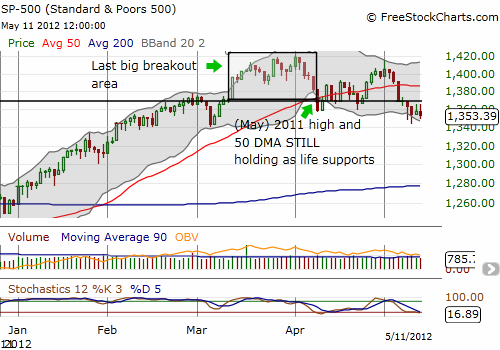

It has been another week since I wrote the last T2108 Update, and another week the market has churned. The S&P 500 ended the week down a little over 1%, clinging to the bottom of critical resistance/support formed by the May, 2011 highs and the index’s last big breakout to new multi-year highs.

Note that the stochastics in the chart show the S&P 500 is very oversold. In fact, the index is now more oversold stochstically than at any other point this year. Yet, the oversold conditions have also persisted for a week without generating a bounce. I only show this as a reminder that being short the index is a bit hazardous. If T2108 flips oversold in the coming week as I expect, then I will position for a large subsequent bounce. A rally back to the May highs would be consistent with my last “sell-in-May” analysis that determined the best time to sell in May is in the first week of May or at the very end. A subsequent failure to break the May highs or a failed retest of 2012’s high would be consistent with a topping market.

The volatility index, the VIX, is maintaining the suspense by hovering around the critical 21 level. As a reminder, this is the level at which 2011’s summer swoon began.

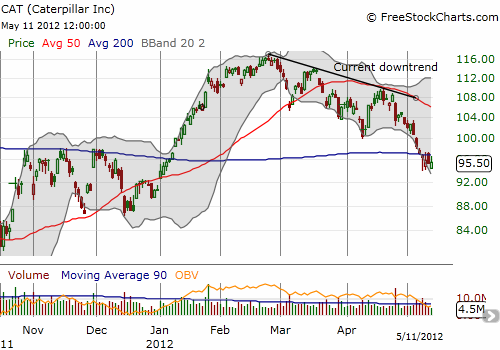

The Caterpillar (CAT) watch is flashing a bright yellow warning sign as it finally broke below its 200DMA last week. CAT spent the rest of the week churning below this critical technical level. Follow-through to the downside should at a minimum signal (or proceed) a tumble to T2108 oversold. I will interpret the failure of CAT to regain the upperhand over its 200DMA in an oversold bounce as a very bearish signal.

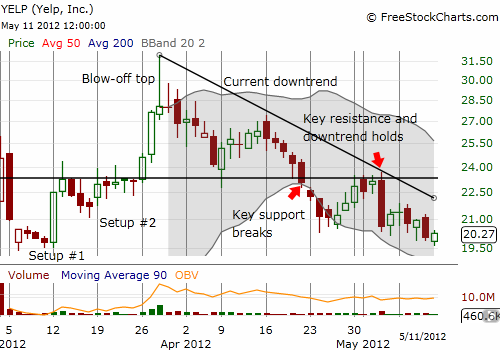

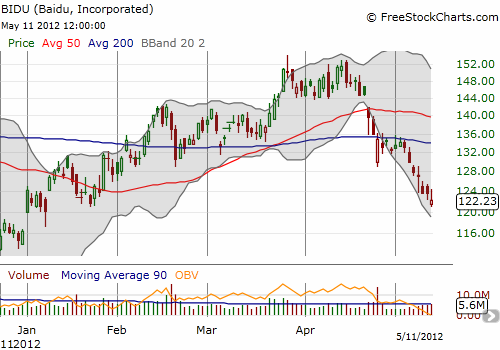

A week ago I posted chart reviews on stocks that all looked very vulnerable: YELP, BIDU, and SFLY. The charts below show that they have all followed-through to the downside.

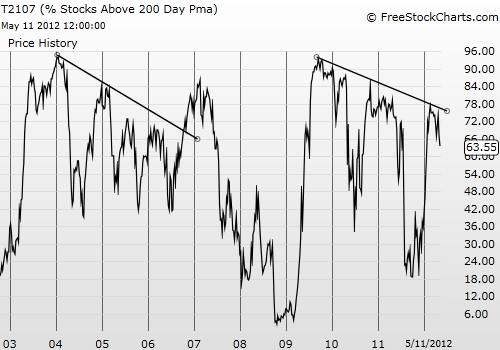

With T2108 in the mid-30s, we know that there are many stocks falling off trend. This is a clear case where the major index hides the real story. The S&P 500 is still just a few percentage points away from fresh multi-year highs yet there appear to be many stocks breaking down. T2107, the percentage of stocks trading above their 200DMAs, continues to flag a longer-term bearish signal. The chart below shows T2107 remains in a downtrend since late 2009. This suggests that slowly but surely, fewer and fewer stocks are participating in the general stock market rally. When this happened during the last bull market, one last rally threw me off the bearish scent. If history repeats itself, we will get another strong rally to break the current T2107 downtrend before things really fall apart. Note carefully that I thought 2011 would be that year. With an election in November, it seems even more likely that a rally could ensue in anticipation of election results (whatever it is the market will consider good versus bad at that time).

Another key difference with the current T2107 downtrend is that the market has already experienced two major sell-offs. These periods of angst were of deeper relative magnitude (measured by T2107) than what happened before the last bull market ended. It is very possible then that a lot of selling pressure has already been released from the market.

In other words, while T2107 is alarming, it remains too early to make a conclusive statement about its implications. So, I will not again boldly predict the coming of a bear market after a final Fall rally (although last October we got close to a bear market BEFORE a fresh rally!).

The trading call remains a hold because T2108 is still not telling us much here. However, being closer to oversold than to overbought, I have continued to bias my short-term trades to the bullish side. Moreover, I still see in the rearview mirror the massive and historic overbought period that began the year. I have bought SSO calls on dips to sell into the next rally. Last week, I let profits slip and ended up partially salvaging SSO calls that expired last Friday. The last small batch expire this coming Friday. I do not think those are well-positioned if the market hits oversold this week. I am putting a hold on these purchases of SSO calls until T2108 falls oversold. In the meantime, I continue to find unique stock-specific opportunities, both bullish and bearish. I have described these in other posts and/or in my tweets.

(Note – as of May 11, 2012, some glitch in FreeStockCharts.com is screwing up the overlay of the S&P 500 with T2108).

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SDS; long VXX put, long CAT shares and puts, long SSO calls