(This is an excerpt from an article I originally published on Seeking Alpha on May 3, 2012. Click here to read the entire piece.)

It is that time of year again when traders try to predict whether this year’s summer cycle will compel them to dump stocks in May only to return in the Fall.

In previous posts on the “sell in May” cycle, I have come to the following conclusions:

{snip}

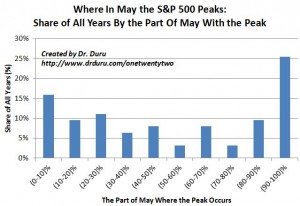

With the S&P 500 flirting with multi-year highs just like last May, I wondered at what point in May does the S&P 500 tend to peak? A quick turn of the data crank reveals that from 1950-2011, May tends to peak at the start or end of the month. {snip}

Click image for a larger view…

Source: price data from Y!Finance

{snip}

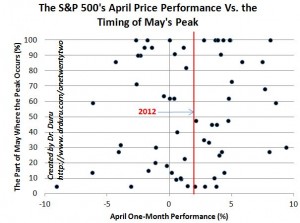

If May is so consistently treacherous, one might expect traders to sell in April to get ahead of the killing fields. Yet, it does not show up in the data. {snip}

Click image for a larger view…

Source: price data from Y!Finance

In other words, traders worried about the sell-in-May cycle can likely afford to wait until May (or later) to time their exodus. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 3, 2012. Click here to read the entire piece.)

Full disclosure: long SDS