(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 54%

VIX Status: 15.5%

General (Short-term) Trading Call: Trade with a bullish bias. (click here for a trading summary posted on twitter)

Reference Charts (click for view of last 6 months from Stockcharts.com):

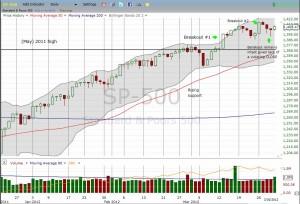

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar)

Commentary

Friday’s T2108 (54%) and VIX (15.5) numbers are an exact repeat from Wednesday’s. The S&P 500 closed slightly up for the week but there was a lot of excitement in between. I was able to execute several more successful trades on SSO calls, especially as the S&P 500 bounced nicely off lows on Wednesday and Thursday. While sellers were able to erase all the gains from the last impressive breakout, they could not keep the index CLOSED below those levels. So, no surprise then that the S&P 500 rallied a bit on strong buying volume to close out the month and the quarter. The bullish bias remains firmly in place.

Click image for larger view

With T2108 sitting at 54% there remains plenty of room for more upside as buyers looking for relative “bargains” amongst the stocks that have started diverging from the S&P 500’s good fortunes. Again, I will maintain my bullish bias until at least the next trip to overbought territory given the strong performance that tends to follow extended overbought periods like the one that started 2012.

On Friday’s Nightly Business Report, Sam Stovall, Chief equity strategist from S&P Capital IQ provided some interesting historical stats on S&P 500 performance although he did not fully explain the date range for the data (emphasis mine):

“Whenever we have had an advance in the first quarter in excess of 5 percent, following an advance in the fourth quarter, in excess of 5 percent, as we did this time, the market has advanced 80 percent of the time in April, posting a 2.5 percent gain on average. And also has advanced more times than not in the second quarter, gaining 4 percent on average. So, it appears as if possibly the trend will remain our friend…Let`s face it, we are now in the first year of a new bull market. After suffering through more than 21 percent decline on an intraday basis going back through the October of last year.”

Stovall failed to mention the length of the relevant historical period, but these data are very consistent with my historic analysis of overbought periods. Stovall’s reference to the October lows is a great reminder of how last year’s multiple swoons likely washed out a lot of sellers from the market, paving the way for even the light volume advances that persist on the major indices.

The Caterpillar (CAT) watch continues, and I have included it in my important list of charts to track. Currently, the new downtrend remains intact, but it bounced enough to avoid closing March on a new low. CAT is also still very oversold on stochastics. As a reminder, CAT’s recent breakdown is now my biggest non-confirming signal of this rally.

Finally, note a few other changes. The trading call has been changed from “hold with a bullish bias” to “trade with a bullish bias.” This change more accurately reflects my current strategy since I continue to hold SDS shares and VXX calls as important hedges to my aggressive short-term trading in SSO calls and VXX puts. Also, going forward, I will minimize the amount of detail I provide on trades in the T2108 Update. I am trying to shorten the amount of time it takes to write these summaries and provide just the most critical info and data. You can always find summaries of my most important or relevant trades on my twitter feed using the #120trade hashtag. I now include a link to this feed at the top of the T2108 Update. I will break down trades in the T2108 Update if I feel they are particularly instructive (whether good or bad).

Charts below are the latest snapshots of T2108 (and the S&P 500)

Refresh browser if the charts are the same as the last T2108 update.

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SDS; long SSO calls; long VXX calls and puts; long CAT shares and puts