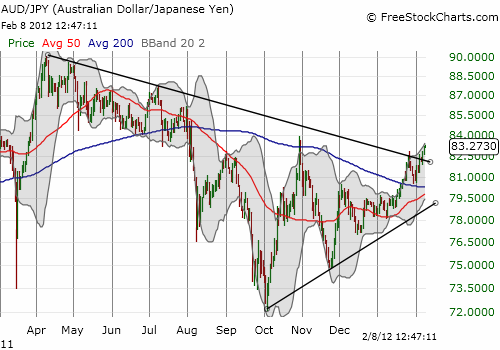

A week ago, I reviewed the technicals on the Australian dollar versus various currencies. If you blinked, you missed the picture-perfect setup against the Japanese yen (AUD/JPY). I pointed out that a retest of the 200-day moving average would provide a good entry point. AUD/JPY did not quite touch this point of important support, but the bounce from that point as been quite convincing. AUD/JPY has now broken out from the previous wedge pattern, a very bullish move.

Source: FreeStockCharts.com

I think this breakout confirms the renewed strength of the Australian dollar AND the (gradual) peaking of the Japanese yen. If this run continues, it is a clear sign that financial markets are firmly “risk on.”

The recent fundamentals supporting the Australian dollar are last week’s extremely strong trade balance numbers, and this week’s decision by the Reserve Bank of Australia (RBA) to hold steady on interest rates.

Australia’s trade balance for December handily beat expectations for a contraction and instead jumped to $1.7B. This 27% increase from the previous month signals that the global economy, particularly China’s, is still hanging in there OK.

Analysts got it wrong on interest rates as well. The RBA surprised analysts by holding rates at 4.25% instead of dropping them to 4.0%. In its monetary policy statement, the RBA noted a balance of risks and potential in global and domestic economies. Most importantly, the RBA decided to give itself room in case further cuts are necessary to battle weakening demand. An event they are not yet expecting:

“At today’s meeting, the Board noted that interest rates for borrowers have declined to be close to their medium-term average, as a result of the actions at the Board’s previous two meetings. With growth expected to be close to trend and inflation close to target, the Board judged that the setting of monetary policy was appropriate for the moment. Should demand conditions weaken materially, the inflation outlook would provide scope for easier monetary policy. The Board will continue to monitor information on economic and financial conditions and adjust the cash rate as necessary to foster sustainable growth and low inflation.”

All things considered, my bullishness on the Australian dollar against all currencies has firmed even further.

Buy the dips and be careful out there!

Full disclosure: long AUD/JPY