This is an excerpt from an article I originally published on Seeking Alpha on January 6, 2012. Click here to read the entire piece.)

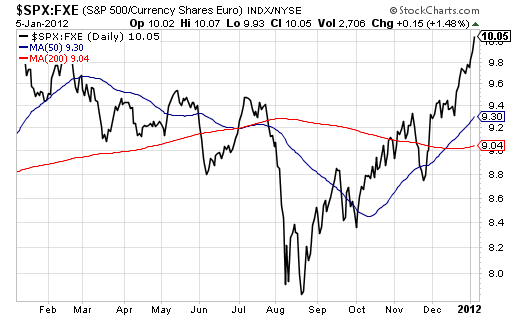

It seems that the U.S. market has grown weary of worrying about the euro. The euro has lost 4.5% versus the U.S. dollar (EUR/USD)(FXE) since December 9, 2011 while the S&P 500 (SPY) has managed to gain 2.1% over that time. Moreover, the index is up 6.3% since its December lows. The euro is now trading against the U.S. dollar at levels last seen September, 2010. The S&P 500 is pushing against October highs and making a bid to finally erase all its losses from last August’s swoon. The chart below shows that overall the S&P 500 has steadily out-performed the euro for several months.

Source: Stockcharts.com

{snip}

To start accommodating euro fatigue, I executed two main strategic changes over the last two weeks.

I first closed out my standing short position in EUR/USD. {snip}

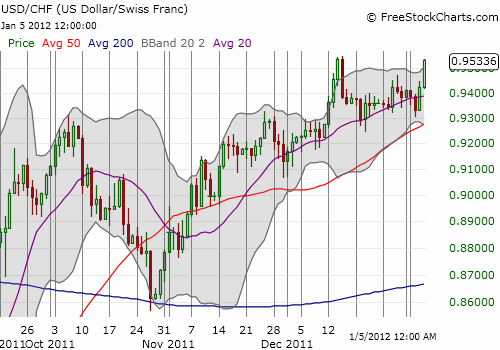

I next closed out the positioning for a devaluation in the Swiss franc. A month ago I laid out a strategy for playing the devaluation of the Swiss franc. {snip}

I recently locked in final profits and closed out all positions in Swiss franc currency pairs… {snip}

In the meantime, I will trade dips in the non-euro Swiss franc currency pairs free of the need to make sure I am not caught over-weighted francs in a surprise intervention. {snip}

Source for last two charts: FreeStockCharts.com

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on January 6, 2012. Click here to read the entire piece.)

Full disclosure: long FXF, USD/JPY, FXA